Dive Brief:

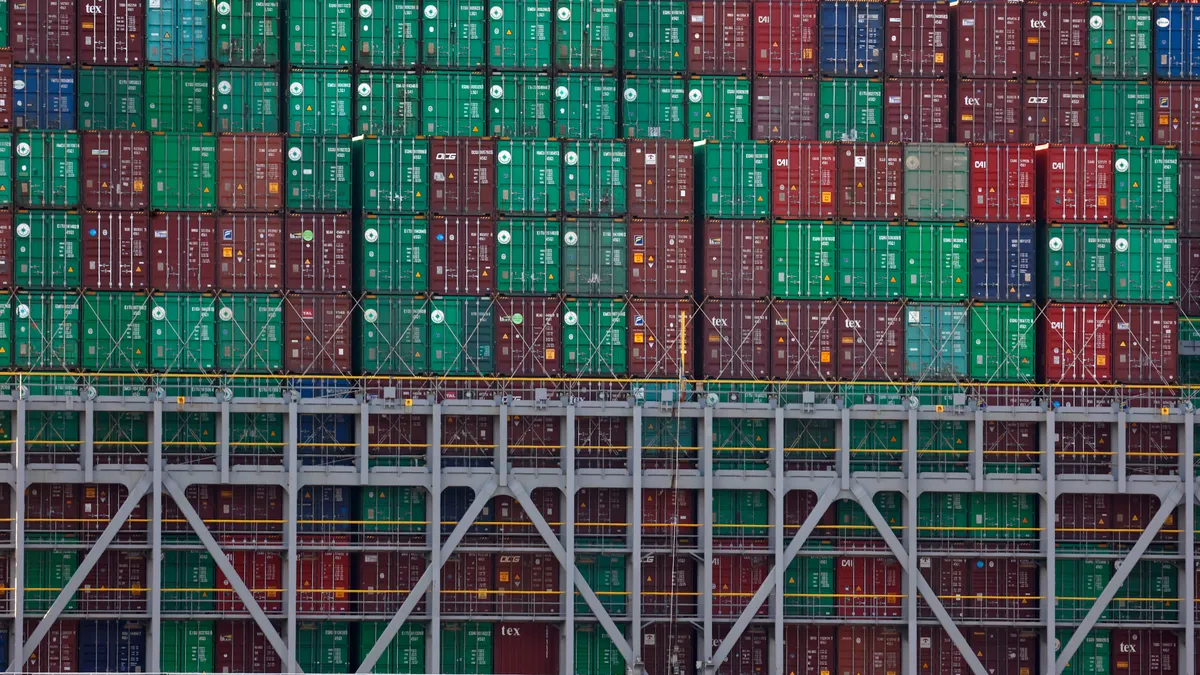

- Triton, a container-leasing company, has ordered 890,000 TEUs, worth $2.6 billion, of new containers so far in 2021, most of which it expects to be delivered by July, CEO Brian Sondey said on the company's earnings call last week.

- The company said "most" of this new capacity is already committed to long-term leases, according to the company's presentation.

- "The container manufacturers have significantly ramped up production to meet demand, but the availability of containers remains limited, and alliances have continued to rely heavily on these companies for their containers," Head of Global Marketing and Operations John O'Callaghan said on the call.

Dive Insight:

As manufacturers and retailers try to meet consumer demand for goods, logistics providers that help to move that inventory have experienced increased demand. Ocean carriers, forwarders and trucking companies have all seen interest in their services grow in recent months. Triton is no different.

"The balance of container supply and demand remains highly favorable for us," Sondey said, referring to the market as "very strong."

The trend began last year and has continued as federal stimulus and the inability or lack of desire to spend on events has tipped the balance toward physical goods — sending imports soaring.

The Port of Los Angeles' import volume rose nearly 123% YoY in March to reach 490,115 TEUs — up almost 65% compared to the same month in 2019. And March was the Port of Long Beach's busiest month of all time.

The demand for ocean shipping sent container prices surging. Last year, the leasing prices per container had already surged from the usual $100 to $250 to reach $750 to $1,000 per container. This has continued, according to Triton.

"The leases negotiated in 2021 have an average duration of 12 years," and there has been an "increase in market lease rates as container prices jumped to meet demand," O'Callaghan said.

Hapag-Lloyd announced last month that it ordered 150,000 TEUs of new dry and reefer boxes, and 8,000 TEUs of special containers, citing the container shortage for necessitating the $550 million investment.

Matson is also growing its container fleet and began purchases last summer, executives said on an earnings call last week.

"We got out early on ordering additional container equipment and chassis and other things, kind of before everyone else realized the potential strength of this market," Matson Chairman and CEO Matthew Cox said on the call.

As companies expand their container fleets, container manufacturers are increasing their prices. Triton said it was seeing rates close to $3,500 per container.

"Obviously right now [is] a golden time for Chinese container manufacturers, because they produce as much as possible and can basically charge whatever price they want," Florian Frese, marketing lead at Container xChange, told Marketplace in March.