Dive Brief:

- Class 8, medium-duty and trailer backlogs are "essentially" filled into 2022, with inventories below traditional levels, Kenny Vieth, ACT Research's president and senior analyst, said in a recent press release for the firm's "Commercial Vehicle Dealer Digest" report.

- Vieth said the semiconductor situation is not expected to be fixed this year, although there are reports of supply improvements. Still, that has not led to higher build rates, Vieth said.

- The supply chain problem for makers of trucks and trailers is a multi-headed serpent, as steel supplies remain tight and OEMS struggle on their own to provide tires, foams and plastics, Vieth reported. The supply chain problems are a greater driver of capacity constraints than consumer demands, Vieth said.

Dive Insight:

ACT Research confirmed what OEMs have been disclosing for weeks. Tesla, for example, said last month it would once again delay production of its battery-electric Semi. The vehicle is now planned to launch in 2022.

Not only are shortages disrupting product launches, they're also blocking OEMs from keeping up with typical orders. FTR reported that, while 2021 trailer orders are in, OEMs are being hampered by labor shortages, as well as component constraints.

"Fleets are desperate for new dry vans to compensate for the shortage of new trucks and drivers in the current tight capacity environment. There is a growing amount of freight to be moved and the industry continues to struggle to deliver it on time," Don Ake, FTR vice president of commercial vehicles, said in a statement.

Net U.S. trailer orders

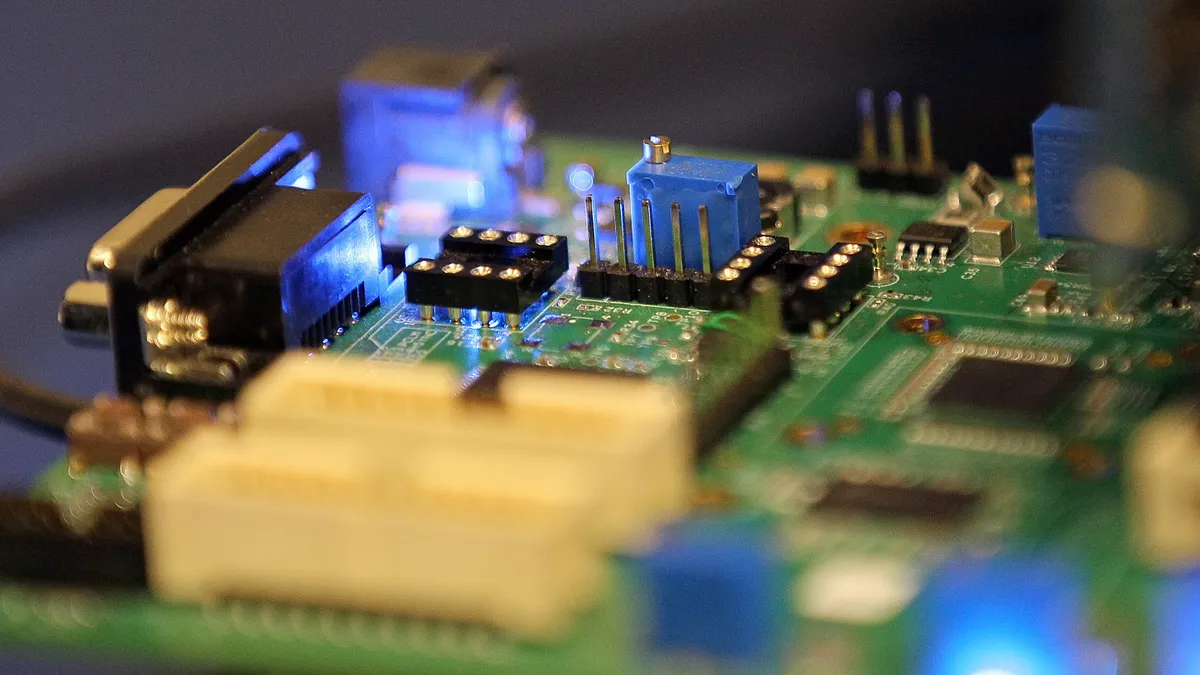

Like, trailers, tractor production is also running behind. Computer chips are used liberally in tractors, as they are in cars. The semiconductor chips collect data, and between 15 to 35 can be needed, per tractor, according to Ake.

Companies such as Tesla that rely more heavily on high-tech parts may be hurting the worst, after fires in Japan at an AKM factory last October and Renesas Electronics factory on March 19. These events contributed greatly to the chip shortage and compounded every other problem brought on by COVID-19.

Ordering for 2022 has started but is delayed, FTR said, and truck supply is running an estimated 25% behind demand.

"Most of the unproduced orders will roll into the first quarter of 2022. If those months are already booked solid, it creates even more headaches for the industry. Things won’t approach any degree of normalcy for months," Ake said in a statement.

Class 8 net truck orders in North America

Even the gradual reopening of the economy caused headaches for OEMs, as the largest port complex in North America, the ports of Los Angeles and Long Beach, became clogged with ships full of cargo, including parts used by OEMs. In March, it became clear to shippers they would have to temporarily anchor cargo ships off California, as dock workers and truckers worked their way through the ships at port.

The economy shows no sign of slowing, or easing pressure on ports. Vieth said GDP growth will likely be 6.2% in 2021 and 2022.

"That bullish outlook is predicated on solid freight metrics and consumers who continue to spend at relatively higher rates on goods, as well as millennial demographics, record savings and wealth, and pent-up housing demand that all bode well for continued strength in freight-related economic activity," said Vieth.

It all adds up to OEMs working on backlogged truck and trailer orders through 2021 and possibly most of 2022.