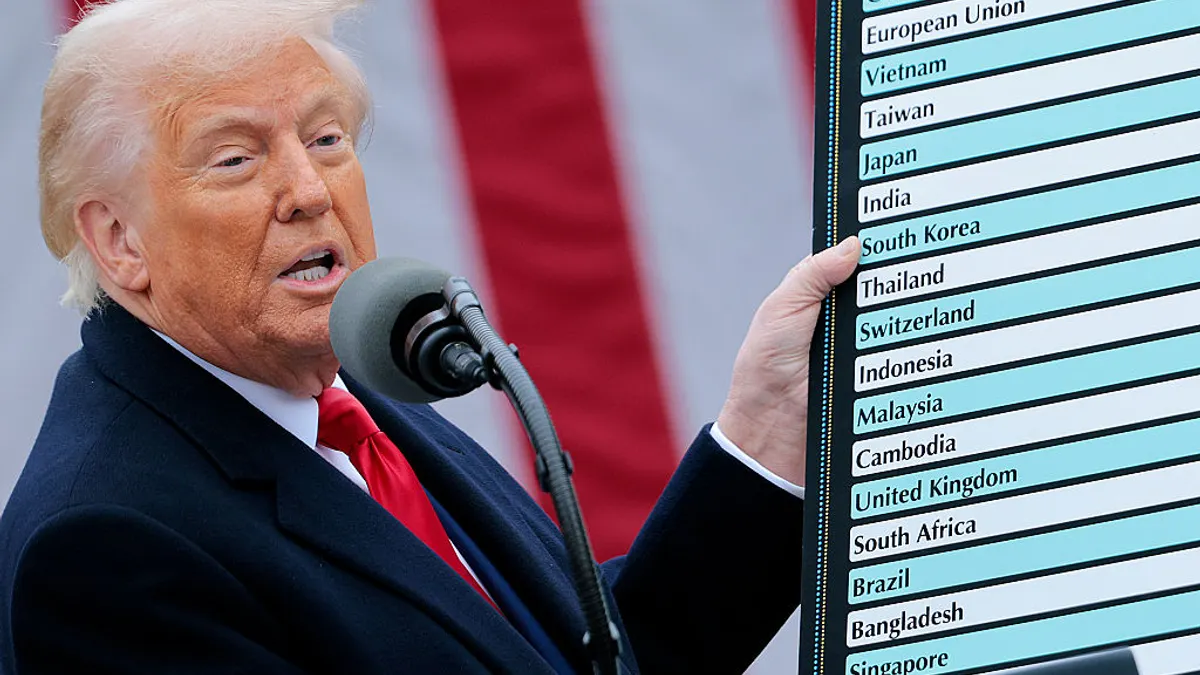

Within days of winning the 2024 presidential election, Donald Trump began ramping up his plans to increase tariffs in the name of protecting U.S. jobs and manufacturing.

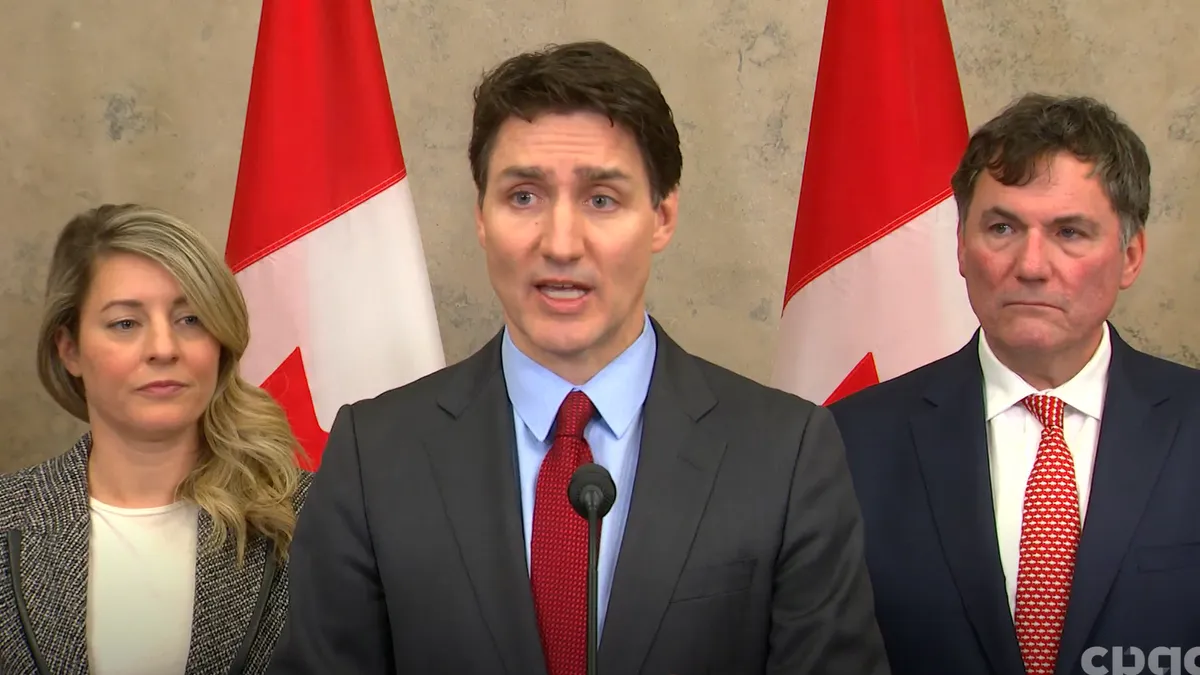

The president-elect has promised to implement 25% tariffs on Mexico and Canada, as well as an additional 10% tariff on goods made in China, on his first day in office.

The plans echo the aggressive tariff policy the president-elected deployed during his first term, when he levied wide-sweeping tariffs on China during a two-year trade war. Trump also pursued tariffs on U.S. trading partners in Asia, North America and Europe, including duties on steel and aluminum from Mexico and Canada.

Ahead of what could be an onslaught of new tariff hikes that Trump claims he’s ready to implement as soon as this month, manufacturers and retailers are preparing their supply chains for a new trade landscape.

Here are ways experts say companies are adapting.

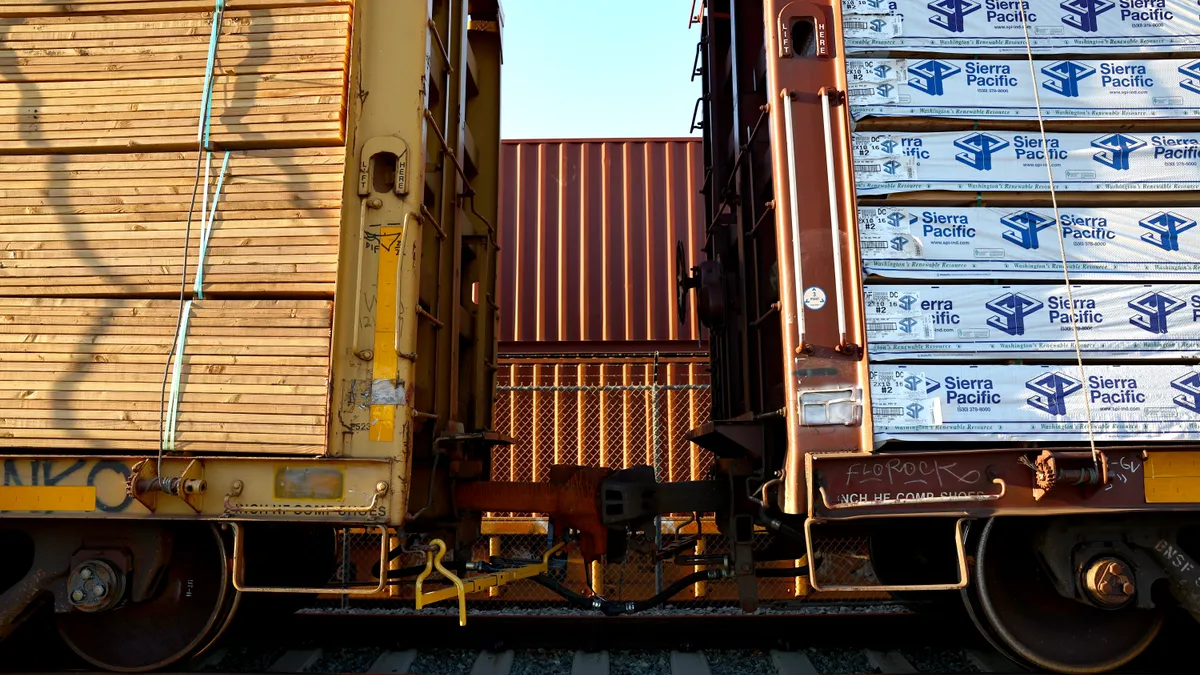

Frontloading inventory is only a short-term solution

Even though new tariffs are likely, most companies are avoiding radical shifts to their supply chains until more concrete action has been taken at the federal level, said Madhav Durbha, group VP of CPG and manufacturing at supply chain technology company Relex Solutions. That level of certainty won’t be available until Trump is in office.

One of the most popular tactics companies are already employing is frontloading imports and stockpiling inventory ahead of Trump’s inauguration, according to Jonathan Todd, vice-chair of the transportation and logistics practice group at law firm Benesch Friedlander Coplan & Aronoff.

However, that won’t address the long-term implications of tariffs and is far from a one-size-fits-all solution, especially for less shelf-stable goods like food.

Alternative sourcing and supplier relationships

Tariffs implemented by the last two presidential administration have accelerated a move to diversify sourcing outside of China or to eliminate sourcing from the country altogether.

The most attractive regions to shift to have been in Southeast Asia well as Mexico and, to a degree, Canada, according to Todd. Countries like Vietnam, India, Turkey and parts of Europe like Poland have also become more commonplace locations from which to source goods, Durbha said.

Moving production and sourcing into new countries is far from easy, however, as it can take at least five years to sufficiently change a company’s sourcing makeup, according to Todd.

Beyond an extended completion timeline, shifting to new countries also relinquishes the volume advantage of single-country sourcing and comes with significant cost requirements, Durbha said.

“If you're setting up shop in new countries, you have to account for regulatory compliance there, which is very different from, say, regulatory compliance in U.S. or China,” he added.

Moving out of countries targeted by tariffs may not be the right call for every company, especially for those with strong supplier relationships. In this instance, companies should proactively negotiate with their suppliers and change their buy- and sell-side expectations, according to Todd.

“Perhaps the cost burden of those increased tariffs for landed goods should be born equally, or in some balance between seller and buyer, which is to say that foreign producers maybe internalize some or all of that cost for a period of time,” Todd said.

Improving visibility

Shippers should fully map their supply chains to understand where all supplies and inputs originate. Performing a thorough examination of the origin of inputs can be particularly useful, according to Evan Chuck, a partner at law firm Crowell & Moring.

“It's like taking that bill of material and really scrubbing it down to if it's some mineral, let's find out where, what mine it came from, right? If it's plastic, which barrel of oil?” Chuck said.

Companies can also review their product classifications to ensure they have proper expectations for tariff impacts, said Brett Johnson, a partner at law firm Snell & Wilmer.

“It's not like companies can knee-jerk react to everything that is being said and Tweeted or put on Truth Social."

Madhav Durbha

Group VP of CPG and Manufacturing at Relex

Manufacturing in foreign-trade zones, also known as free-trade zones, is another potential safety net against tariffs, experts said. Goods produced in these zones are not subject to U.S. Customs and Border Protection jurisdiction, as they are shipped for consumption outside of the U.S.

Domestic sourcing and playing politics

Of course, the safest and easiest way to protect against tariffs is to lean on domestic production. Trump has argued that higher tariffs will entice companies to bring manufacturing operations back to the U.S, but experts are less convinced of the strategy.

“The challenge with domestic sourcing is, of course, that you know the capacity is not what it used to be, and even if you can find domestic producers of supply, many of those inputs are from foreign sources, and so those will have burden from the tariff increases as well,” Todd said.

Exemptions could provide relief to some companies if tariffs take effect.

Any exemptions would be dependent on the specifics of new tariffs. Under President Joe Biden’s 2024 tariff increases, the Office of the United States Trade Representative authorized exemptions for certain inputs for domestic manufacturing equipment and set a March 31, 2025, deadline for companies to submit exemption requests.

For any company hoping to earn an exemption, it will be critical to have strong ties to Capitol Hill, Chuck said.

Although there are many strategies available, shippers should ensure their tactics support more rigorous scenario planning to prepare for whatever tariffs may come.

“It's not like companies can knee-jerk react to everything that is being said and Tweeted or put on Truth Social,” Durbha said. “I think what they're doing is they're being a little bit more thoughtful and saying ‘OK, at least the crux of the story is that I need to build optionality in my supply chain.’”

Alejandra Carranza contributed to this article.

This story was first published in our Procurement Weekly newsletter. Sign up here.