President Donald Trump said he plans to implement a 10% tariff on China-based imports as soon as Feb. 1, according to a press briefing at the White House Tuesday night.

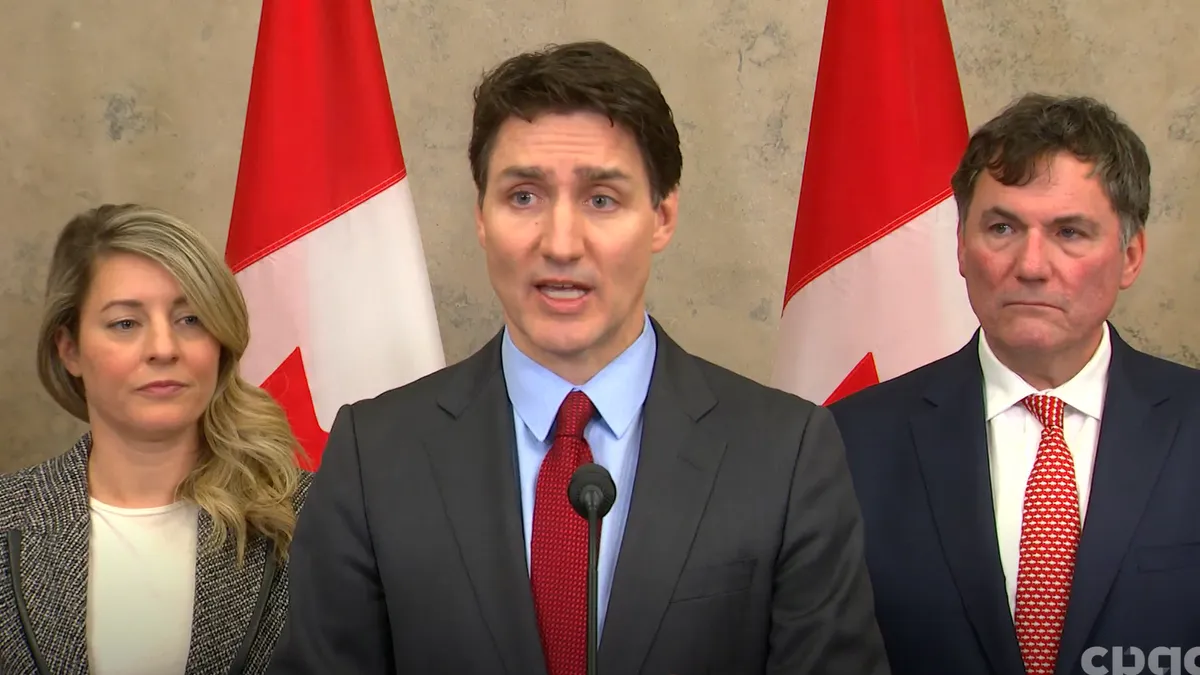

Trump issued a similar remark during inauguration day about his plans to enact 25% tariffs on Canada and Mexico by the same date. Both statements line up with promises the president made following his reelection in November.

While Trump originally said in November that he would sign a day one executive order to implement tariffs on China, Canada and Mexico, on Monday he instead issued a memorandum directing federal agencies to evaluate U.S. trade policy.

During Tuesday’s press briefing, Trump cited the importation of fentanyl from China into Mexico and Canada as a reason for the 10% tariffs.

“We’re talking about a tariff of 10% on China based on the fact that they’re sending fentanyl to Mexico and Canada,” Trump said. “Probably Feb. 1 is the date we’re looking at.”

A Feb. 1 implementation date for new tariffs would be within the timeline Trump set in his trade review memorandum Monday. As part of the order, federal agencies have until April 1 to recommend potential remedies to U.S. trade challenges, which could include tariffs.

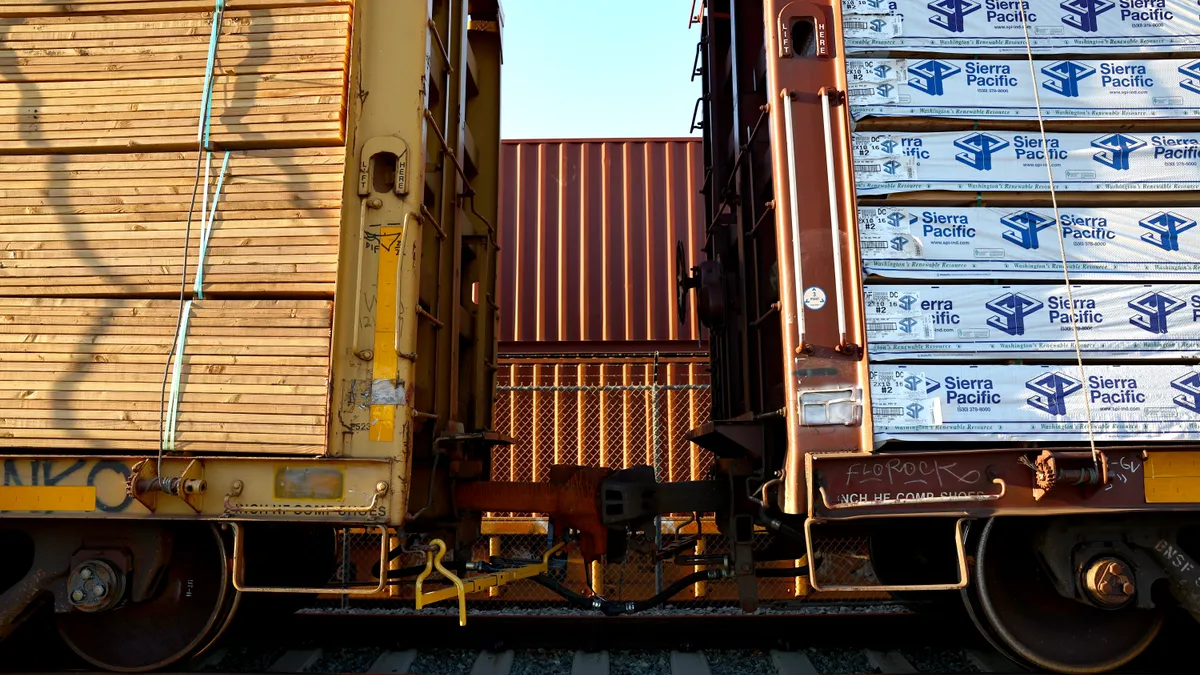

Retailers and manufacturers got a taste of Trump’s use of tariffs during his first term, when he levied wide-sweeping duties on China during a lengthy trade spat. Trump also introduced tariffs on other U.S. trading partners, including Mexico and Canada.

Trump’s insistence on pursuing the tariffs he originally promised would put pressure on the U.S.’s top three trading partners, but the more specific goal of any actions would differ for each country.

With the review date of the United States-Mexico-Canada Agreement looming in 2026, Trump could employ tariffs as a negotiating tool, which could prompt Canada and Mexico to do the same.

New tariffs will create other challenges at home and abroad. Potential retaliatory tariffs from targeted countries, particularly China, would have the most obvious and direct impact on U.S. companies, according to Jonathan Todd, vice chair of the transportation and logistics practice group at law firm Benesch Friedlander Coplan & Aronoff.

Tariffs could also reduce U.S. consumer spending power by up to $78 billion, per a November study from the National Retail Federation.

U.S. companies operating in China could also face potential changes to export control laws and anti-foreign sanctions laws, said Evan Chuck, a partner at law firm Crowell & Moring.

For example, if a U.S. company backs out of a deal with a China-based manufacturer due to U.S. sanctions or tariffs, it could be subject to legal action and even be blacklisted.

“I think China is now in a better position to weather some of the storm, especially as it becomes more friendly with countries that are not necessarily aligning with the United States,” according to Brett Johnson, a partner at law firm Snell & Wilmer.