The White House released a summary of its U.S. trade policy review findings Thursday in the wake of President Donald Trump’s order for a baseline 10% tariff and country-specific duties.

Trump initiated the review during his first day back in office in January. In a memorandum, he directed cabinet officials, including the U.S. Trade Representative and Secretary of Commerce, to evaluate U.S. trade agreements and potentially unfair trade practices by other countries.

The memorandum set April 1 as a deadline for officials to report their findings and suggest potential remedies, including the use of tariffs. Trump had already instituted some duties in the interim, with the global levies he ordered Wednesday building on some of the report's findings.

“The Report makes recommendations to the President to reduce the trade deficit, including the imposition of a tariff on certain imports in pursuit of reciprocity and balanced trade,” the summary says, noting that the full report will not be made public.

Here are six important takeaways from the summary that indicate potential future actions by the Trump administration.

1. China is under the microscope

The U.S.’ trade relationship with China faced particular scrutiny in the review. The summary says that China has not lived up to its side of the 2020 trade agreement with the U.S, particularly in regards to agriculture, financial services and intellectual property rights protection.

Officials also assessed the Biden administration’s Section 301 investigation into China's trade practices and determined that additional reviews under the provision may be needed.

Even prior to Tuesday’s report, the Trump administration had already initiated tariff hikes on imports from China by 20%. Trump on Wednesday announced that the U.S. would charge a 34% reciprocal tariff on China as part of a country-by-country implementation.

2. Current trade deals are in line for updates

While evaluating the U.S.’ relationship with China was a major piece of the review, all trade pacts were also investigated, including the United States-Mexico-Canada Agreement.

The USTR is required to initiate a review of the USMCA ahead of its July 2026 renewal deadline, according to the summary. It also says that “numerous changes are needed” for the USMCA, including stronger rules of origin and expanded market access, but it does not indicate the U.S. will pull out of the deal.

Canada and Mexico are both currently subject to 25% tariffs for non-USMCA compliant imports, but the two countries escaped any further duties under Trump’s new tariff announced Wednesday.

Including the USMCA, the Trump administration’s review also examined its 14 current trade deals that cover relations with 20 different countries.

The review recommends the modernization of these arrangements and addressing the causes of imbalances, but does not call for the dissolution of any, per the summary. Instead, the report identified certain countries with which the U.S. should consider negotiating new agreements with, although they were not listed in the summary itself.

3. The U.S. is aiming for tighter export controls, anti-dumping measures

The U.S. should consider several measures to address unfair trade practices, including stricter export controls and stronger antidumping and countervailing duty policies, per the summary.

“Export controls should be simpler, stricter, and more effective, while promoting U.S. dominance in AI and asserting global technological leadership,” the summary says.

On the antidumping front, the summary recommends the U.S. add new countries to its list of non-market economies and create improved means of implementing and enforcing statutes meant to deter the practice.

4. Further investigations are likely

Tuesday’s report may just be the tip of the iceberg when it comes to the Trump administration’s reevaluation of U.S. trade policy.

As part of the review, the Secretary of Commerce was tasked with identifying whether additional investigations into certain sectors were required to protect national security.

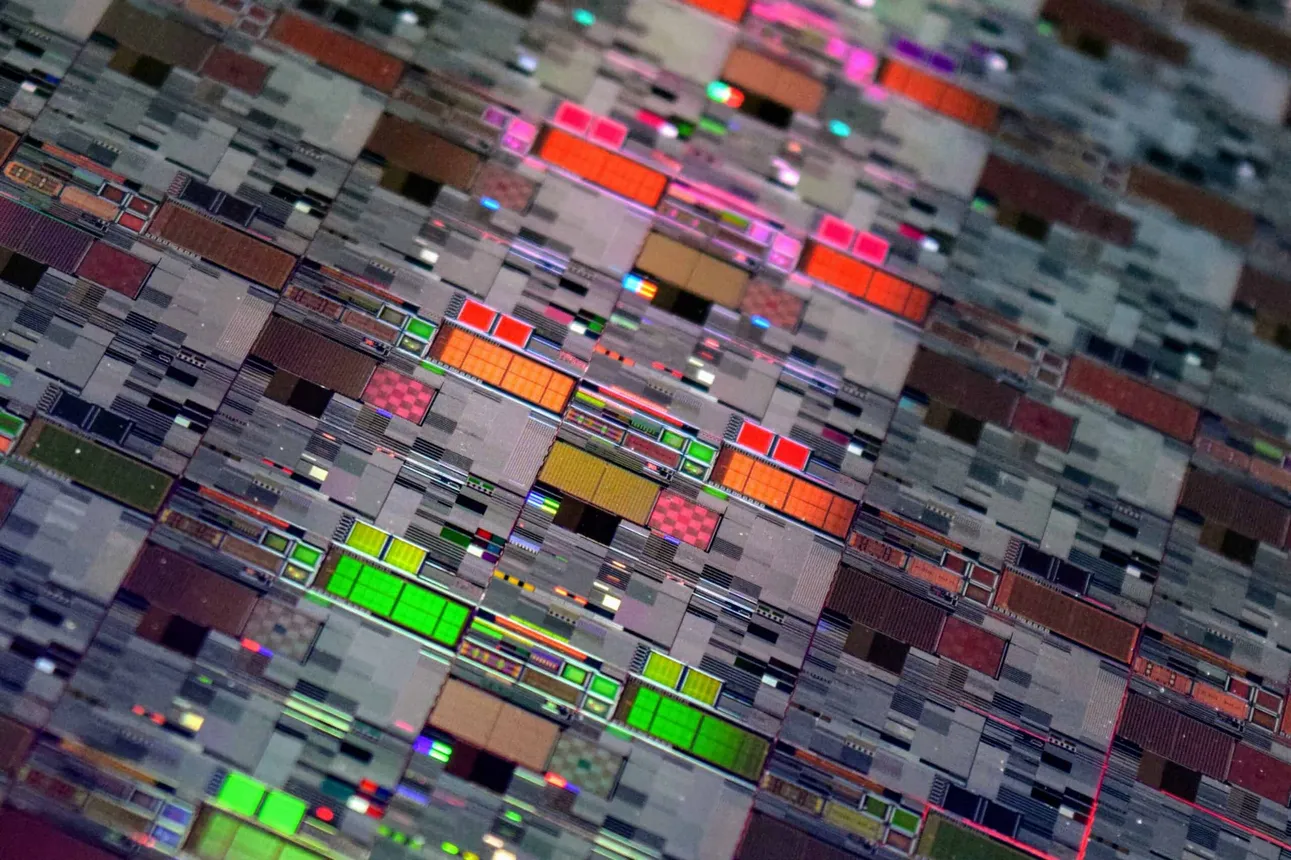

To that end, Trump has already levied steel and aluminum tariffs, as well as duties on cars and automotive parts, and has indicated duties on pharmaceuticals and semiconductors will be next. He has also initiated reviews of the U.S.’ wood and copper supply chains.

The Commerce Department specifically identified pharmaceuticals, semiconductors and certain critical minerals as sectors that should be considered for new Section 232 investigations in Thursday’s summary. Notably, an annex to the tariff executive order Trump signed Wednesday provided exemptions for certain of these goods.

5. The de minimis exemption’s future is bleak

The de minimis exemption, which grants duty-free status to imports of under $800, has been caught in the crossfire of Trump’s trade actions.

Trump signed an executive order Wednesday specifically eliminating the provision for imports from China and Hong Kong, and he’s unlikely to stop there.

“The United States should end this duty-free de minimis exemption,” Thursday’s summary says, arguing that it costs billions of dollars of tariff revenue and poses security risks to the U.S.

6. The External Revenue Service may be closer to reality

Speaking of collecting revenue, Trump directed officials to evaluate the feasibility of creating an External Revenue Service during the trade review. Such a service would oversee the collection of tariff revenue, an operation currently handled by U.S. Customs and Border Protection.

Thursday’s summary falls short of fully endorsing such a maneuver, but it did note that the “creation of an External Revenue Service (ERS) offers an opportunity to improve tariff collection.”