Dive Brief:

- Uber's new global grocery delivery operation generated gross bookings at a $1 billion annualized run rate in September and is on track to bring in business at multiple times that pace in 2021, CEO Dara Khosrowshahi said Thursday during an earnings call.

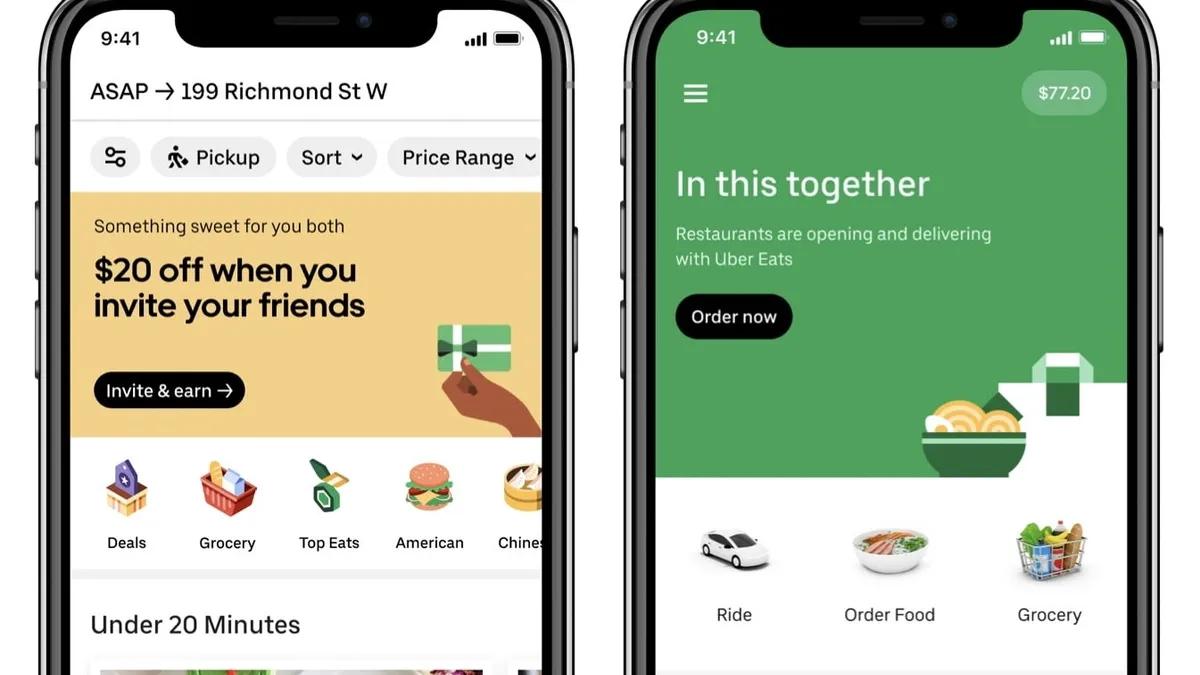

- Uber has shifted toward being a delivery-centric company as the pandemic battered its core business of matching drivers and riders. Overall, Uber's 4-year-old delivery business generated $8.6 billion in bookings during the third quarter, up 135% on a year-over-year basis, Uber announced.

- As Uber goes up against Instacart and Shipt, and as it tries to sign on grocers that are trying to own more of the e-commerce experience, Khosrowshahi said the company sees significant growth ahead in grocery-driven memberships.

Dive Insight:

Uber's foray into the competitive grocery delivery space earlier this year is emerging as a pillar of the company's ongoing effort to evolve from its ride-hailing roots into a multifaceted logistics organization.

Although grocery is now just a small part of Uber's fast-growing food-delivery segment, Uber Eats, Khosrowshahi said transporting goods from supermarkets to consumers' homes represents a key opportunity for the company. With a large number of people already signed up to use Uber's better-established ride-sharing and food-delivery services, the company believes it is in a good position to rapidly scale its grocery operations.

In the United States, Uber now provides grocery delivery services to customers of only a handful of stores, including selected Winn-Dixie and Fresco y Más supermarkets in Florida and some grocers in New York City, but has big expansion plans. “We think we're in the very, very early days,” Khosrowshahi said.

Other areas targeted for growth include prescription delivery, where Uber launched pilots in Dallas and Seattle.

Khosrowshahi also addressed California's Proposition 22, passed by voters Tuesday that exempts gig-worker-dependent delivery platforms like Uber from the state's worker-classification law. That law requires businesses to classify contractors as employees and generated fierce resistance from Uber and its rivals.

“California voters listened to what the vast majority of drivers want: new benefits and protections with the same flexibility,” Khosrowshahi said about the measure, which Uber and competitors including DoorDash, Instacart, Lyft and Postmates together spent about $200 million to support. “We feel strongly that this is the right approach. We should be adding benefits to gig work to make it better, not getting rid of it altogether in favor of an employment-only system.”