Dive Brief:

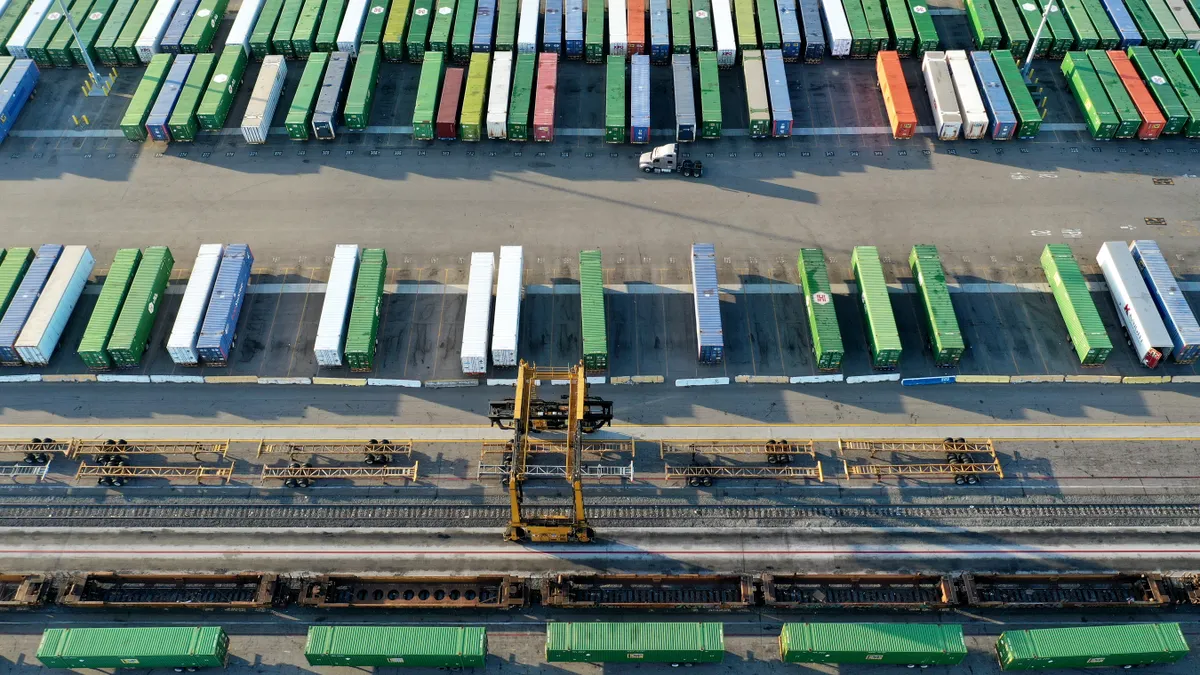

- Union Pacific and BNSF are reducing the number of railcars in their network in an effort to control congestion and address service problems caused by labor constraints and rising inventory levels.

- Union Pacific will reduce the number of its own cars and plans to meter traffic beginning April 18 if shippers don't voluntarily reduce inventory, according to a letter to customers. Potential limitations on traffic would not affect intermodal as "major international intermodal terminals remain fluid," the railroad said in a statement to Supply Chain Dive.

- BNSF, meanwhile, will work with private railcar owners and its own system fleet managers to reduce inventory levels in an effort to quickly restore service and address backlogs. The railroad is confronting "challenges in generating significant overall velocity, inventory level and fluidity improvement," according to an April 8 intermodal update.

Dive Insight:

Low rail utilization at the Port of Los Angeles in February had pushed port leaders to encourage shippers to divert more shipments from truck to rail as a way to clear congestion. Now railroads face the opposite problem as they struggle to move a deluge of cargo.

Rail volumes rose sixfold within the last month alone, Gene Seroka, executive director of the Port of Los Angeles, said at a media briefing Wednesday. Approximately 16,000 containers are waiting to load on-dock rail, almost double the number from last fall.

"Both Western railroads had seen worryingly low numbers for a number of months, and everybody in the industry rallied around them to get more intermodal cargo," said Seroka. "That cargo is here—and we've got to handle it better."

BNSF said key areas of its network, including the San Pedro Bay ports, are experiencing reduced railcar availability due to delays in "freight moving off the railcars and out of our inland intermodal facilities," according to a statement to Supply Chain Dive. The railroad added that strong volumes, longer dwell times and chassis constraints in the Chicago area have resulted in extended wait times for trains to be unloaded, ultimately slowing their return to the West Coast.

Agricultural shippers have noted significant rail disruptions around the country that have pushed producers in some cases to halt operations. In a letter to the Surface Transportation Board, the National Grain and Feed Association noted delivery delays meant some shippers ran out of grain and had to shut down flour and feed mills.

"In an effort to continue service for customers during the rail service disruptions, NGFA members have done as much as possible to keep animals fed, but the ability to stretch resources is exhausted and growing more tenuous with each additional day of service delays," the group wrote, adding shippers have seen significant service disruptions with Union Pacific, BNSF and Norfolk Southern.

Union Pacific said it's working closely with ports, marine terminal operators and ocean carrier customers "to coordinate the increasing amount of import containers to inland destinations," according to a statement to Supply Chain Dive.

Both Union Pacific and BNSF are ramping up hiring efforts to address attrition and other labor constraints that have affected service across the rail industry. BNSF plans to bring on an additional 1,000 train crew personnel this year, and Union Pacific said it is aggressively hiring and streamlining its onboarding process.

The railroads are also adding locomotives and limiting the number of cars in their networks in a bid to maintain network fluidity. Union Pacific has added 50 locomotives since January and will remove between 2% and 3% of its cars across multiple commodity groups, according to the cusomter letter. BNSF said in its intermodal update it will add 100 locomotives this month. It will reduce railcar inventory by 2%, according to a letter in response to NGFA.

"While some progress has been made reducing the backlog at our intermodal terminals on the eastern side of our network, we continue to confront challenges in generating significant overall velocity and fluidity improvement," BNSF said in its statement to Supply Chain Dive. "That being said, we are working diligently to effectively handle strong freight volumes and ensure that capacity is available in key intermodal markets."