UPS unveiled its growth plans for the years ahead at the delivery giant's investor and analyst conference on Tuesday, with executives outlining the company's "better and bolder" approach to bolster revenue and profit despite tough market conditions.

"Better and bolder means being very selective in the markets that we want to serve, and serving them better than anyone else," CEO Carol Tomé said.

Tomé and other top UPS officials provided details on the company's future with Amazon, the evolution of its pricing technology, excess carrier capacity and how it's looking to gain share from competitors during the conference. Here are five key takeaways from the delivery giant's wide-ranging presentation.

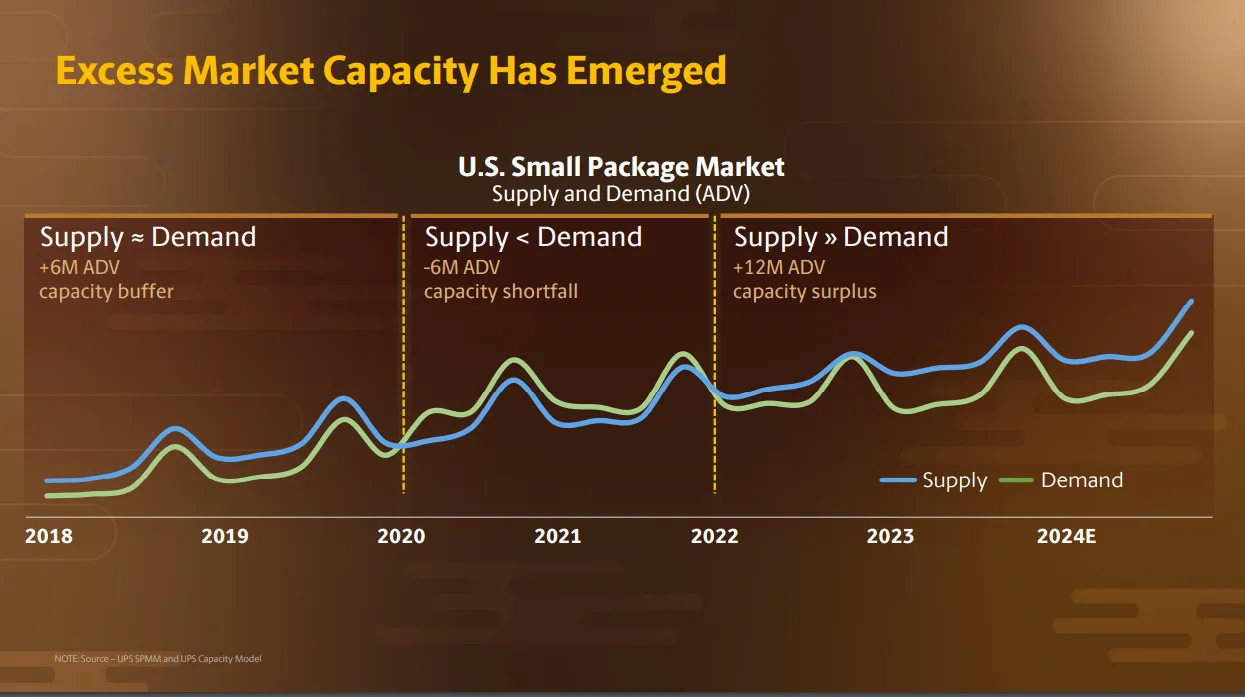

1. U.S. delivery market has a capacity glut

UPS estimates a carrier capacity surplus worth 12 million in average daily volume in the U.S. small package market today, with about half of that excess tied to the U.S. Postal Service, said Matt Guffey, UPS chief commercial and strategy officer.

That's a sharp contrast from the capacity shortfall of 6 million packages between 2020 and 2022, when the COVID-19 pandemic spiked demand and strained carriers' operations.

"The industry is expected to revert to equilibrium as the market grows and we optimize capacity," Guffey said.

Some excess market capacity is a good thing, Tomé said. Before the pandemic, market supply outpaced demand by about 6 million parcels. The current glut will be absorbed by a return to volume growth in the market, along with capacity being removed, she added.

2. "Glide-down" with Amazon is over

The "glide-down" in volume that UPS delivers for Amazon is now over, with activity expected to be stable going forward, Tomé said.

"There are services that we can provide for them that they find really relevant and important, and packages they're going to continue to deliver for themselves," Tomé said of Amazon. "So from a volume perspective, think of them as equilibrium for the next three years."

UPS' revenue derived from Amazon fell to $10.7 billion in 2023, its lowest annual total since 2019. If Amazon volume is poised to be stable going forward, that means UPS will have to pursue volume growth from other customers and segments while taking share from competitors.

Excluding Amazon, U.S. delivery activity declined by 2.4 million packages a day in 2023, according to Tomé. Volume growth in the current market is largely driven by Amazon's in-house delivery operations, Guffey added.

"This means to grow, we are leaning into parts of the market that are aligned with our competitive advantages," Guffey said.

3. Pricing technology evolves

UPS is relying more on Deal Manager to help grow its customer base. The tool uses data science and machine learning to provide UPS’ sales team with real-time guidance on pricing, allowing them to close shipping deals faster with small- and medium-sized businesses.

"We are seeing win rates of about 80% on Deal Manager," Guffey said. "So our sales force is winning more, they're winning faster and they're winning better."

Guffey said 95% of all deals less than $1 million use the tool. By the third quarter of this year, UPS expects nearly all deals up to $10 million to be priced in Deal Manager.

UPS is also developing a more nimble pricing approach on its Digital Access Program, an initiative connecting the company to top e-commerce platforms to offer rate discounts and other services for shippers. Fastlane, a new capability for the program, unlocks more flexibility for UPS to adjust rates on a transaction-by-transaction basis, Guffey said.

"Prior to Fastlane, offering new product capabilities took months," he said. "Now we can do it in days and weeks, and when it comes to rate changes, we can implement within 24 hours."

UPS has seen growth in its Digital Access Program, more than doubling its customer base since 2021 with 5 million on board and 25,000 more being added weekly, Guffey added.

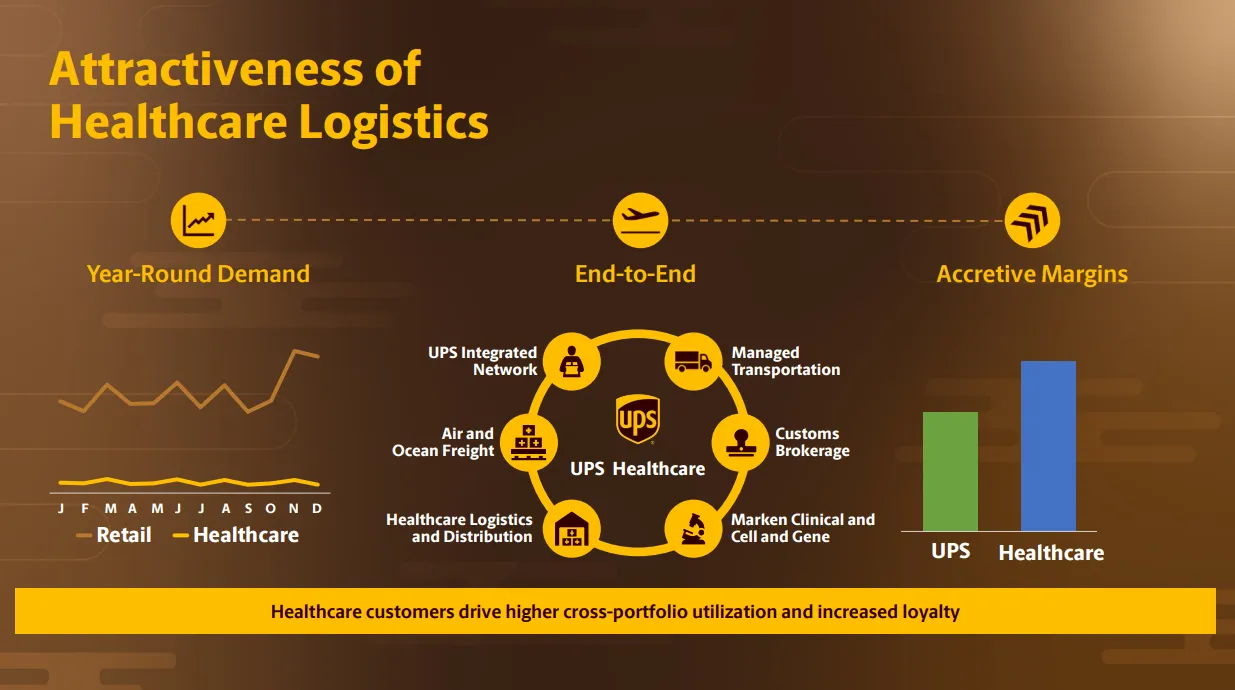

4. UPS looks to double healthcare revenue

UPS aims to reach $20 billion in annual healthcare revenue by 2026, doubling the amount it made in 2023, after strengthening its capabilities in the sector through acquisitions and new facilities.

Along with small and medium-sized businesses, healthcare is a key customer target as it is generally more profitable than home deliveries on a per-shipment basis.

"The healthcare logistics market is a major strategic move for UPS, because the demand for healthcare is growing, and healthcare companies of all sizes are rapidly innovating to keep pace with the needs of an aging population and problems related to chronic disease," said Kate Gutmann, UPS EVP and president of international, healthcare and supply chain solutions.

UPS is specifically focused on becoming the top provider of complex healthcare logistics, a market that is projected to grow to $82 billion in 2026. The company's investments in healthcare logistics capabilities are centered around six growth segments: Cold chain, clinical advanced therapies, labs and diagnostics, pharma, home healthcare and medical devices, Gutmann said.

UPS aims to leverage its end-to-end capabilities to help reach its 2026 revenue goal and differentiate itself from its competitors.

"[There are] tens of thousands of specialized healthcare logistics providers that do a piece, but not the whole," Gutmann said.

5. UPS launching new weekend sorts

UPS will offer Saturday package pickups for Sunday sortation starting in Seattle, Houston, Boston and Minneapolis this year, said Nando Cesarone, EVP and President U.S., speeding up delivery times by injecting volume into its network earlier.

"For example, when a customer has a scheduled Saturday pickup they can reach many of their customers a day faster with a Monday delivery," Cesarone said. "We can also accommodate shippers to inject volume on Sundays for that same Monday delivery."

UPS plans to launch new weekend sorts in 26 origins overall. That will help UPS better balance volume levels throughout the week.

"Our peak day is actually Wednesday, and the more we can de-peak the week and spread that volume across the days, the better off we'll be economically," Cesarone said.