UPS will have trouble passing off higher labor costs resulting from a new contract with the International Brotherhood of Teamsters, experts interviewed by Supply Chain Dive say.

The wider variety of alternative carriers today versus 1997 — the last time UPS Teamsters went on strike — and softer delivery demand are key reasons why. As a result, shippers have less of an appetite to accept aggressive rate hikes from UPS and others than in years past, when they were fighting for limited carrier capacity.

Right now, UPS has no rate increase to announce, a spokesperson said. The carrier periodically evaluates its prices “to ensure it reflects the value we provide,” he added.

UPS, FedEx and other carriers typically announce annual rate increases in the second half of the calendar year. Last year's 6.9% increase from UPS cited the need to support ongoing expansion and enhance its capabilities as reasons for its implementation.

"The one thing we do know is the rates will go up at some point, but by how much of it due to what they end up giving the Teamsters is anyone's guess," said Michael Foy, director of business development at Inmar Intelligence. "They have to remain competitive."

The company and the Teamsters have yet to reach a tentative agreement on their next national contract, and the union has vowed to strike if a deal isn't reached before the current agreement expires July 31.

It remains to be seen how much wages will increase in the next contract, as the two sides recently hit a roadblock over part-time pay. Still, UPS employees are poised to see higher wages. The Teamsters union is pushing for significant pay raises, while the company said in a statement last week it has offered "historic proposals that build on our industry-leading pay" during negotiations.

At the same time, UPS will want to minimize the impact a new deal will have on its bottom line, particularly in a softer demand environment.

"They've got to be sharp, they can't just pass everything off to the customer base," Foy said.

FedEx, others would capitalize on higher rates

One factor limiting how much UPS can raise rates is its chief competitor, FedEx. The two delivery giants consistently stay in lockstep with each other when it comes to annual rate increases.

Similar rate increases have even occurred in years UPS and the Teamsters have reached a new contract agreement. In 2018, for example, both companies announced a 4.9% rate hike. Experts have said a difference in rate increases would result in loss of business for one carrier, while the other would struggle to maintain service levels amid a surge in new business.

FedEx isn't the company's only concern.

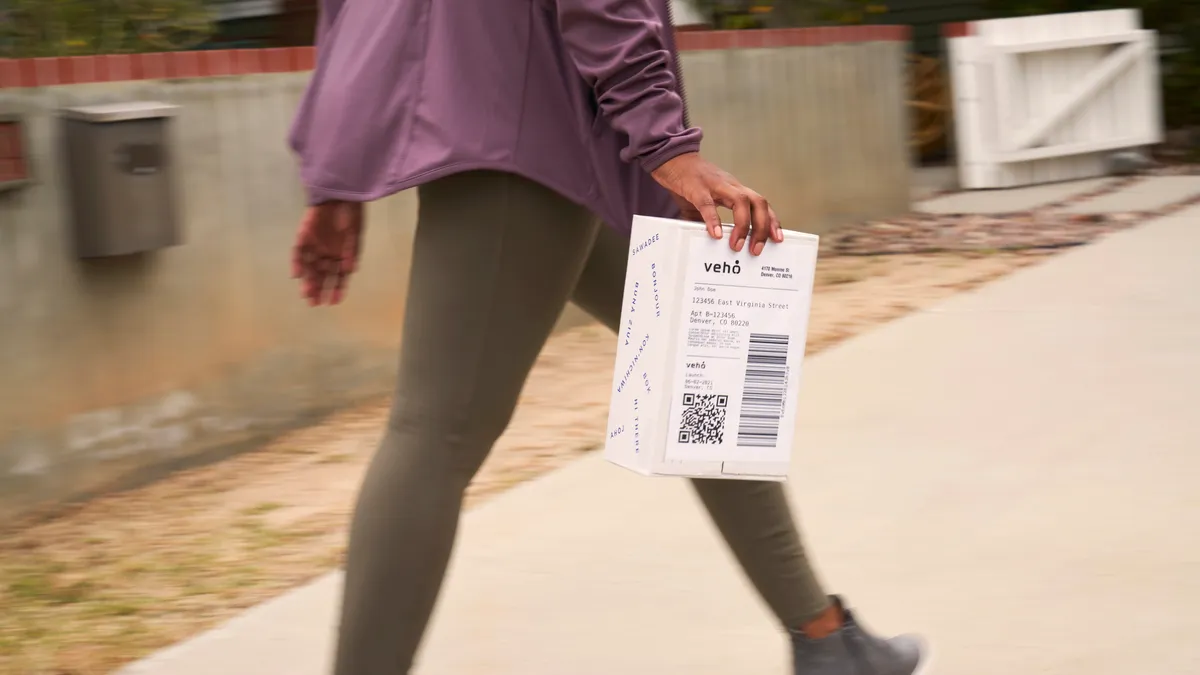

Alternative parcel carriers like OnTrac and LSO have grown since the last time a UPS Teamsters ratified a national contract, further complicating any efforts by UPS to pass on contract-related costs to customers. Many emerging delivery players such as Veho and Walmart GoLocal also use crowdsourced gig drivers, giving them the ability to easily scale their capacity up and down when demand levels shift.

This labor model means UPS' business-to-consumer shippers could see a "potentially significant impact" if a new contract limits the use of deliveries from personal vehicle drivers, said Alan Amling, distinguished fellow at the University of Tennessee’s Global Supply Chain Institute. Limited labor flexibility could constrain UPS' ability to compete for new e-commerce volume versus these emerging players, raising the cost of existing packages flowing through its facilities, he added.

"In order for UPS to remain competitive with all the new B2C players, they're going to have to have more flexibility in labor, and that includes expanded use of personal drivers," said Amling, who previously served as VP of corporate strategy for UPS.

Weaker demand complicates price hikes

Dean Maciuba, managing partner USA for Crossroads Parcel Consulting, said he previously thought UPS would be willing to pay whatever is necessary to reach a deal with the Teamsters. However, a shift in market dynamics over the past year may limit the company's willingness to acquiesce to union demands.

UPS is weathering declines in volume as inflationary pressures and recession concerns weigh on customer demand, which had already been cooling off from its pandemic-driven heights. Higher average discounts on ground parcel shipments this year suggests carriers are competing more aggressively on price to stave off shrinking volume.

UPS demand cooling off after pandemic surge

"What's happened in the last year is carrier pricing power has diminished significantly, and that means it's going to be harder for UPS to pass on rate increases with impunity that are resulting from a [contract] settlement," Maciuba said.

Although UPS is stuck between pressure from the Teamsters on large raises and a more difficult environment to increase rates, bearing the brunt of higher costs is a better outcome for UPS than a strike, according to experts. FedEx recently highlighted its available capacity to concerned shippers, while the U.S. Postal Service believes its new Ground Advantage service could handle a strike-driven demand spike, according to Government Executive.

"The pain that UPS would incur with a strike is far greater than them coming up with a reasonable economic proposal for the Teamsters," said Trevor Outman, founder of Shipware.

Editor's note: This story was first published in our Logistics Weekly newsletter. Sign up here.