Dive Brief:

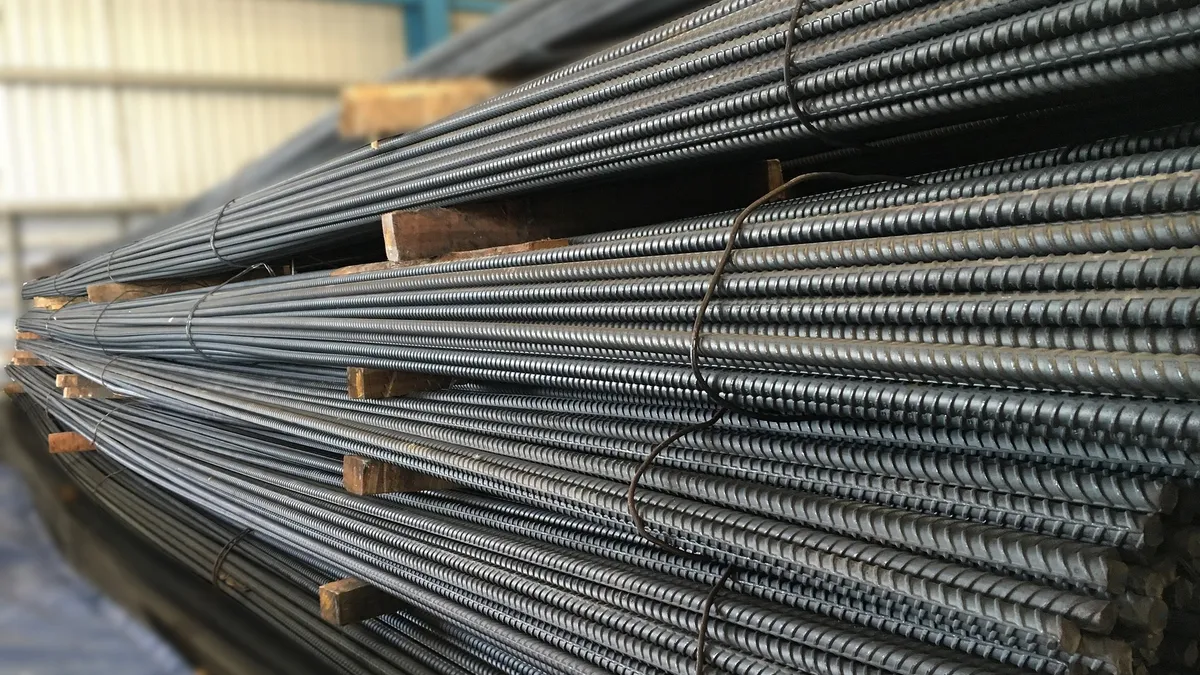

- The U.S. will expand existing 25% tariffs on steel and 10% tariffs on aluminum to cover imports of several items made from the metals, including steel nails, tacks, staples wires and cables, a White House proclamation published Friday stated. The duties take effect Feb. 8.

- In the proclamation, the president said imports of raw aluminum and steel have decreased since tariffs took effect in March 2018, but imports of steel and aluminum derivatives (items made from the metals) have "significantly increased. ... The net effect of the increase of imports of these derivatives has been to erode the customer base for U.S. producers of aluminum and steel."

- Aluminum product tariffs will not apply to imports from Argentina, Australia, Canada and Mexico. Steel product tariffs will not apply to Argentina, Australia, Brazil, Canada, Mexico and South Korea, the proclamation said.

Dive Insight:

Domestic steel producers are among the few beneficiaries of the global trade war. Steel imports in 2019 dropped 17% year-over-year, giving greater opportunity for market share for U.S.-based steel manufacturers.

Steel Dynamics CEO Mark Millett went as far as to describe the trade environment as "very positive" on an earnings call Thursday. Millett said foreign auto producers importing metals from Asia and Europe instead turned their attention to domestic sourcing. "We've been the beneficiary and we've been picking up dramatic amount of market share," he said.

Downstream the supply chain, however, manufacturers expressed less optimism. They said tariffs made imports more expensive and claimed domestic steel producers raised their prices. So whether businesses continued to import or switched to domestic, the result was higher costs of their raw and input materials.

The CEO of a tier two auto supplier testified in September 2018 he stopped growing his business due to the soaring raw material costs.

An analysis from the Trade Partnership projected "huge loss" in jobs downstream from the steel and aluminum industries. Laura Baughman, president of the Trade Partnership, previously told Supply Chain Dive that for every job gained in steel and aluminum, 18 jobs will be lost.

The inflated pricing on raw steel and aluminum led to what Bloomberg's Terms of Trade described as a "perfectly rational decision" on the part of U.S. businesses: import foreign-made finished goods of steel and aluminum rather than the raw materials.

The data reflects such a move. According to the White House proclamation, import volumes of steel nails, tacks, staples and more rose 23% last year (excluding December) compared to the same period in 2017. On aluminum derivatives, including wire and cable, imports surged 127% from 2017 (excluding December) to 2019.

For businesses importing foreign-made steel and aluminum products as a mitigation tactic against tariffs on the raw materials, the latest declaration throws a wrench in those plans and will require a reassessment of business and sourcing plans before the tariffs kick in on Feb. 8.

The continued exclusion of Canada and Mexico from import duties on steel, aluminum and their derivatives is an important factor as country legislatures vote on the United States-Mexico-Canada agreement (USMCA). Tariffs on the metals were among the barriers to passage of the deal.

President Donald Trump is expected to sign the trade deal into law Wednesday, and Canada has begun the ratification process.