The U.S. Postal Service is considering changes to how it works with key shipping partners, a move experts say could challenge service levels and pressure delivery prices.

The proposed changes would affect shipping consolidators, which handle and send customers' parcels to Postal Service facilities for final-mile delivery, experts told Supply Chain Dive. These consolidators, including DHL eCommerce, OSM Worldwide and Pitney Bowes, play a large role in the delivery of USPS parcels, making shippers concerned that the potential changes could have wide-ranging impacts.

"It will ultimately translate to a price increase for the underlying customer," said Derek Lossing, a former Amazon Logistics leader who is now the founder and principal advisor of Cirrus Global Advisors.

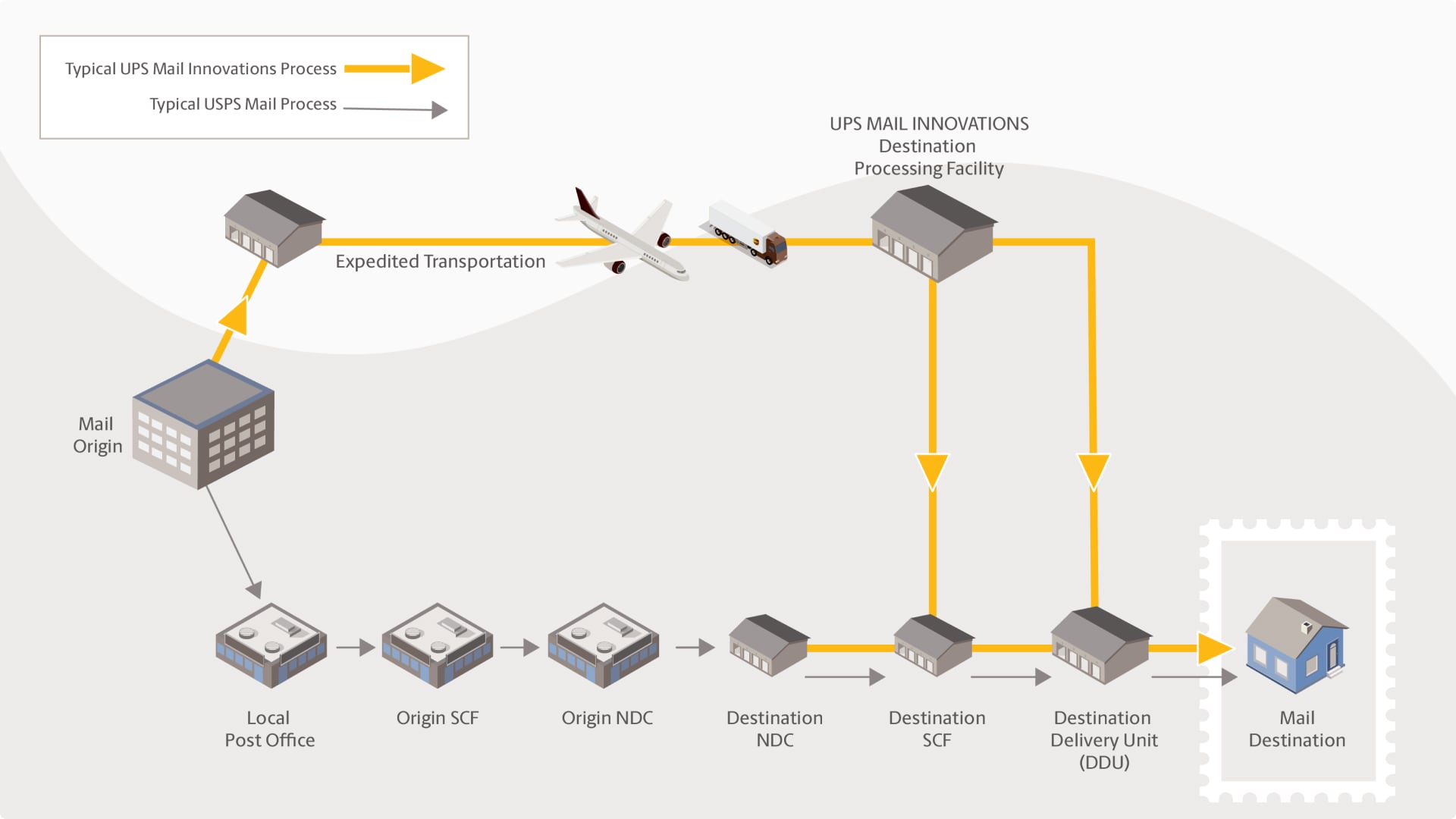

Specifically, USPS has broached key partners to discuss which facility access points are used by shipping consolidators to enter volume into its network, and the negotiated rate discounts tied to that process, several experts told Supply Chain Dive.

The Postal Service wants consolidators to drop off packages further upstream in its network, rather than drop off volume at destination delivery units, which are the last stop in the agency’s network before packages and mail reach their final address.

Consolidators are already familiar with introducing volume at earlier points in the Postal Service’s network, but they often push to inject further downstream delivery units instead to gain more control over their customers' shipments and unlock greater discounts.

The change could expose more shipments to delivery delays in the agency's network, something it has struggled with in the thick of its "Delivering for America" overhaul.

An industry source with direct knowledge of the proposal stressed that the change isn’t imminent. Rather, the Postal Service — which is in the midst of a wide-ranging network overhaul — is beginning conversations with consolidators as to what a transition away from delivery unit injection would look like.

“There was a general guideline that discounted rates on the [delivery unit] inductions are going away, but that hasn’t been further defined as to what the alternative will look like,” the source said of the Postal Service’s proposal.

The Postal Service declined to comment.

Changes could spur workshare partner shakeups

Historically, the Postal Service has benefited from consolidators bringing it volume closer to the final stages of the delivery process.

The arrangement, known as worksharing, allows the agency to avoid the added costs and operational strain associated with processing and handling extra parcels. Most of the Postal Service's commercial packages and mail are covered by a workshare-based discount, the agency's Office of Inspector General said in a 2018 report.

A future with fewer delivery unit volume injections and their associated discounts would complicate these companies' ability to offer reliable and low-cost services through the Postal Service, experts say. Relying on the agency for more steps in the delivery process means increased exposure to potential delays in its network.

"We are in the early stages of our discussions with the USPS on how we can continue working with them to achieve their goals and maintain the same level of service for our customers," said Andrea Scarpulla, a DHL eCommerce spokesperson, in an email.

The potential move could be an attempt by the Postal Service to generate more direct relationships with shippers that use workshare partners while also advancing its long-term cost-savings goals, according to Oscar Gladman, director of parcel carrier development at Geodis. The agency has seen growth in its Ground Advantage shipping service that competes with FedEx and UPS, a bright spot in an otherwise gloomy stretch of quarterly results.

"Why not force that volume upstream a little bit further, charge a higher rate to inject at that point, and now all of a sudden, Ground Advantage maybe looks a little bit more competitive?" Gladman said.

Consolidators could consider shifting volume to other carriers to keep shipping speeds in line with customer needs.

"Don't assume that if you make these changes that regional carriers aren't going to get a lot of [the volume]," said Jim Cochrane, CEO of the Package Shippers Association. "I think they will.”

Proposal falls in line with Postal Service’s long-term plan

Recent service challenges at the agency have received national attention and scrutiny from lawmakers as Postmaster General and CEO Louis DeJoy charges ahead with a network overhaul under the 10-year "Delivering for America" plan.

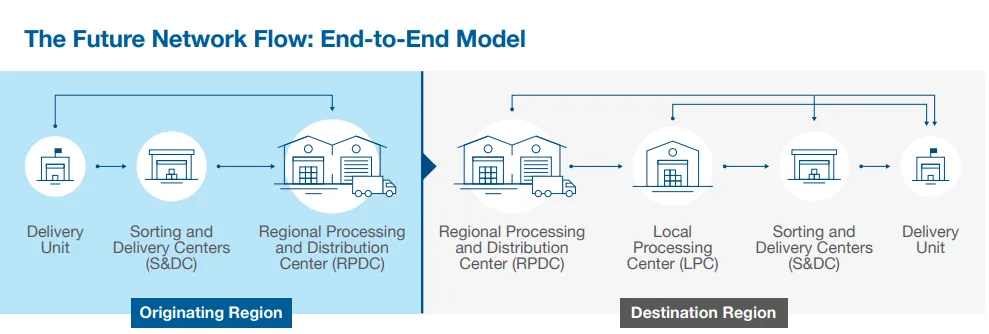

As part of this plan, the agency is consolidating some delivery units into larger-scale sorting and delivery centers to help optimize its facilities footprint. The Postal Service said in a 2023 report that it is evaluating more than 100 new sorting and delivery center locations nationwide to provide faster service between local retailers and consumers.

Amid this shakeup, consolidators are working to assuage concerns that any change to delivery unit injections are imminent. While the overhaul will affect current network entry points, Kevin Collins, president of Postal Service workshare partner ACI Logistix, told Supply Chain Dive that legal challenges, congressional inquiries and Postal Regulatory Commission involvement could delay or impact any future plans.

Cirrus Global Advisors’ Lossing said direct relationships with the Postal Service could help consolidator-reliant shippers avoid added costs spurred by the potential changes. However, he said consolidators would still have advantages for shippers to consider.

“Pitney Bowes can get a contract over the finish line in a couple of weeks and you can start shipping with them,” he said. “That’s not necessarily the case with the Postal Service.”