This year presents a mixture of both upheaval and opportunity for shipping companies that closely partner with the U.S. Postal Service.

The Postal Service notified consolidators, which sort and send shippers' packages to the agency for final-mile delivery, in 2024 of two large-scale changes it would make to advance Postmaster General Louis DeJoy's "Delivering for America" overhaul. Parcel delivery experts warned the moves, focused on consolidators' use of the Postal Service's network and lightweight package pricing, could challenge service levels and increase costs.

As the dust has settled, leaders at top consolidators — DHL eCommerce, OSM Worldwide and ACI Logistix — told Supply Chain Dive this month how their companies have adapted and are pursuing growth in 2025. Adjustments include testing deliveries with other carriers and pursuing heavier packages, bringing more change for a slice of the parcel sector that has navigated plenty over the past year.

"There's a bit of chaos in the market right now, and chaos creates opportunity, and that's what we're looking forward to," said Lee Spratt, DHL eCommerce's Americas CEO.

Consolidators push volume upstream

One Postal Service change could provide some efficiency benefits for consolidators, although the industry is watching closely to see if it will pressure on-time delivery reliability.

The agency officially eliminated contracted rate discounts Jan. 1 for consolidators bringing packages directly to delivery units, or post offices closest to destination addresses, finalizing a process that began last year.

The Postal Service long allowed delivery unit injection so it didn't have to bear added costs for processing and handling extra parcels. But under DeJoy, the agency wants consolidators' volume to instead be brought into its network earlier in the shipping process. The goal is to maximize the flow of volume and make more efficient use of its entire network.

“It’s challenging for us to justify entering into [contracts] that incentivize bypassing our transportation and processing network, while leaving us responsible for managing the final mile, which is often the most resource-intensive part of the delivery process,” DeJoy said in a September announcement.

Consolidator leaders told Supply Chain Dive they were already bringing some volume to locations upstream of delivery units, like sectional center facilities. The Postal Service's actions just boosted that activity, reducing the amount of package drop-off points consolidators looked to cover.

"In a way, not much has changed for us," said Kevin Collins, president of ACI Logistix. "Instead of 20,000 injection points with the USPS, it's just several hundred.”

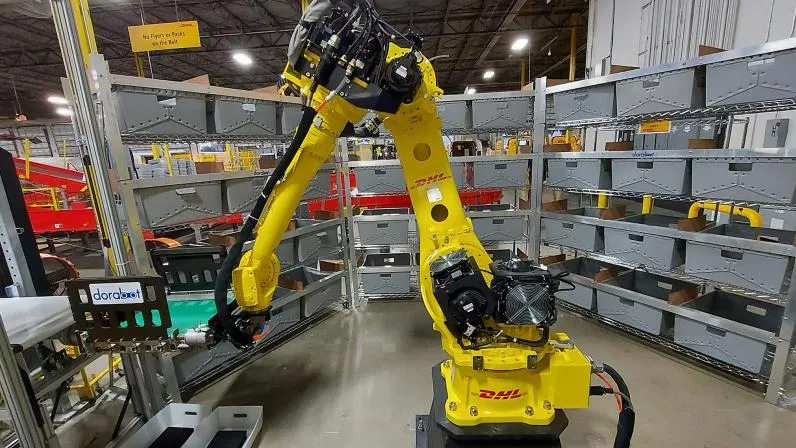

Fewer drop-off points opens the door for operational efficiencies and transportation cost savings, according to DHL eCommerce's Spratt. The company is now sending containers of parcels on trucks rather than "handing off postal sacks to regional carriers," he noted.

Consolidator leaders told Supply Chain Dive that peak season service levels were strong despite the recent shift in entry points. But industry stakeholders worry that the changes increase the risk of shipments being delayed by persistent Postal Service network issues. Criticism continues to mount over the agency's network overhaul and its impact on service reliability.

"This whole concept of trying to pull all this volume in earlier in the network so there's more touches for them — what happens if they can't handle it?" said Tony Runyan, chief client officer at Red Stag Fulfillment.

Experts have highlighted alternative parcel carriers as a potential beneficiary of the shift, since consolidators may look to additional delivery providers to keep service levels high if the Postal Service falters. OSM co-founder and CEO Gaston Curk said while the Postal Service will remain the company's major final-mile carrier, it has also been testing the use of other delivery options in scenarios where it could benefit cost or service.

"We've already started testing, so it's just a comfort level," Curk said. "When do we feel comfortable with them? How do we ramp up and where? And those are all things that we'll talk about operationally per facility, and just kind of take it from there.”

Lightweight volume could shift elsewhere

The other major Postal Service change for consolidators last year was the elimination of ounce-based rates for packages shipped via Parcel Select, a service geared toward large-scale shipping partners. This placed extra pricing pressure on deliveries of packages less than a pound while creating an edge for the agency's growing Ground Advantage product, which offers its own ounce-based rates.

Lightweight package shipping services have long been a pillar of consolidators' offerings, and leveraging the Postal Service's ounce-based rates helped them maintain competitive pricing versus alternative shipping providers.

"Unfortunately, I think to a certain degree, and especially in the really light packages like the zero-to-eight ounce, the price point is going to be a pretty heavy increase there," Curk said.

Where should sub-pound packages go now? Spratt and Curk said the Postal Service's Ground Advantage offering is hard to beat, and the agency is pushing to land more direct agreements with shippers on that front.

"Eight ounces and below, Ground Advantage seems to have a bit of an advantage there, and that's what we're telling our customers," Spratt said.

Other parcel delivery providers are looking to compete against Ground Advantage, seeing the Postal Service's price hikes as an opportunity to attract cost-conscious shippers.

Veho announced the launch of its Premium Economy service last week, with CEO Itamar Zur touting competitive rates on sub-one-pound packages. Similarly, Better Trucks views lightweight shipments as a growth opportunity in addition to its "bread and butter" of 5- to 10-pound packages, Josh Fredman, the company's SVP, said.

"Historically, we haven't been able to play in the space that those prices were in," Fredman told Supply Chain Dive. "And so now that the post office is kind of rationalizing those prices, there's definitely more opportunity for Better Trucks."

If other carriers demonstrate more reliable on-time delivery for lightweight volume compared to the Postal Service, they could gain market share, parcel shipping experts say.

"For anybody trying Ground Advantage, if they get there and the post office breaks, they're not going to go back," said Mark Waverek, managing partner at PlaidMark Management and Consulting Services. "They're going to find an alternative solution.”

Consolidators to tip the weight scales

In response to ounce-based pricing changes, consolidators are looking to make gains in shipping heavier packages.

Spratt said "a five-pound box with a cowboy hat in it was not addressable" under DHL eCommerce's previous network approach, but the shift to shipping larger containers to fewer postal facilities has made this goal more achievable.

"We're really working very diligently to kind of transform from being a lightweight network to more of a 10 pound and less network," Spratt said.

For OSM, Curk said the company had been competitive for packages up to seven pounds but is now looking "to stretch to that 10-pound threshold." He highlighted apparel shipments like hats and shoes as a segment worth targeting during the shift.

ACI Logistix's Collins declined to comment on the impact the ounce-based pricing changes will have on ACI, but he noted that the company is investing heavily in its infrastructure and artificial intelligence technology.

"I think we're going to continue to grow, continue to build on our network, bigger facilities, more automation, more AI, all that kind of stuff that grows the top line and continues to grow the bottom line," Collins said.

"We're really working very diligently to kind of transform from being a lightweight network to more of a 10 pound and less network."

Lee Spratt

Americas CEO, DHL eCommerce

As consolidators look to change or advance their strategies, they'll need to demonstrate their value versus other delivery options competing in the same space, Waverek said. He noted strong customer service and robust tracking features could help them gain an edge as the market adjusts to the Postal Service's changes.

"Everybody's trying to figure out where that sweet spot's going to be, where they can be competitive," he said.