Editor's note: This article is part of a series that looks into the ways supply chains, warehouses and manufacturing facilities are investing in technology. Here's the previous story.

Technology that provides insight into inventory and omnichannel has radically changed warehouse operations in the last five years. Software can take data and automatically turning it into blueprints on how to move inventory in the most efficient and cost effective ways.

While the technology was already there, the pandemic gave it a push.

"Companies are just trying to grapple with how do we do more online effectively, and is our network set up for it," said Chris Riemann, managing director of supply chain and network operations at Deloitte.

In "Innovation Driven Resilience," the 2021 MHI Annual Industry Report, MHI and Deloitte surveyed more than 1,000 supply chain professionals worldwide about innovation investments in the supply chain.

They found that 54% of companies are increasing or substantially increasing their investment in inventory and networking optimization, which is tied with cloud computing and storage as the technology companies are investing the most for resilience (followed by robotics and automation at 53%, and sensors and automatic identification at 52%).

The report also found that 45% of companies are currently using inventory and networking optimization tools, up from 40% from last year — and tied with artificial intelligence as the largest technology use jump in the survey.

The pandemic push

The pandemic's full responsibility for this push is bit of a chicken-and-egg scenario, said Riemann.

"Is technology responding to the needs of folks who operate the distribution centers, or is it the other way because the technology is out there and more people are using it?" he said. "I really think it's the latter."

He cited automated storage and retrieval systems, which can create outbound pallets of mixed product, as an example. The technology didn't exist five years ago, he said. It matured when the pandemic hit, when "folks are looking to not only speed up e-commerce but also reduce the reliance on labor, because labor in warehouses has become incredibly scarce," he said.

Companies spend big on inventory & network optimization

The pandemic also exposed weak supply chains and the need to fix them.

"Until you put pressure on something, you don't know where the cracks are," said Jim Dempsey, director of U.S. business development and partnerships at Panasonic. Companies found where they didn't have visibility into their supply chains, which prompted this kind of investment too.

"There are still a good number of businesses running on paper and Excel, so in order to get visibility, you have to put some automation out where workers are," Dempsey said, even if it's just giving workers mobile devices to scan barcoded inventory, or adopting RFID tags to generate data, and then using warehouse intelligence to "be able to triage it," he said.

Networking and optimization in the future

While the technology is becoming ubiquitous, it's not everywhere yet. Retrofitting distribution centers and warehouses — or building new ones — takes time.

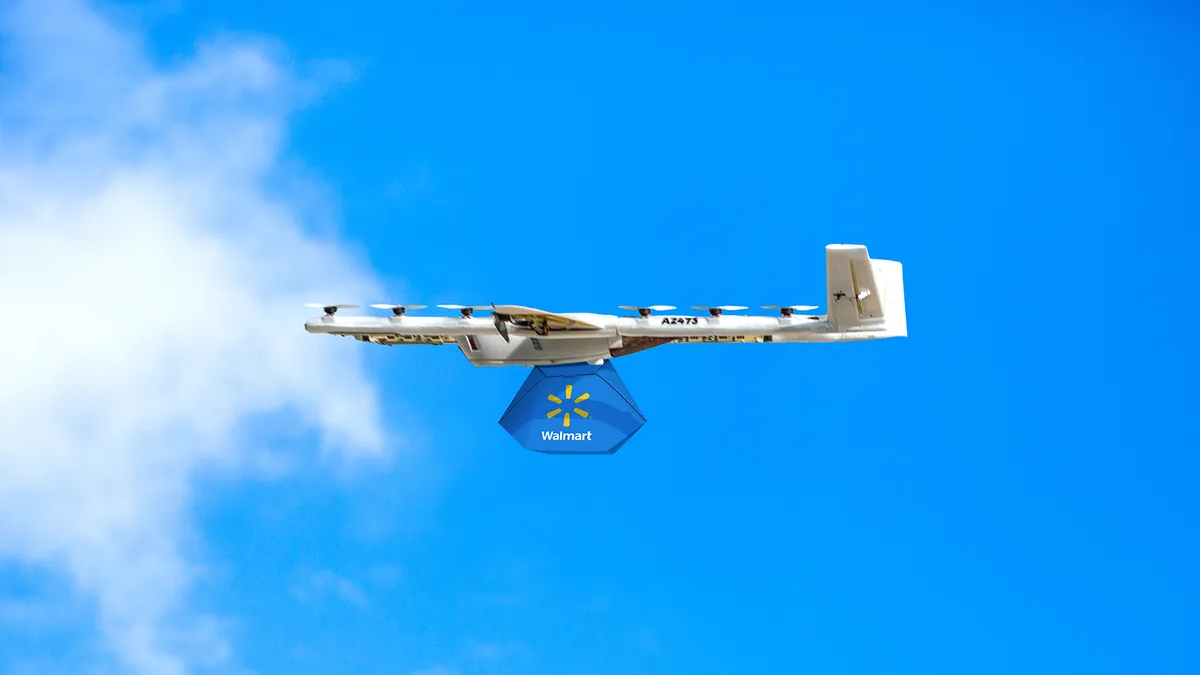

"Five years from now, you're going to be an outlier if you don't have this technology implemented," said Riemann. Vision systems, robotics and drones will also become more mainstream as part of this adoption, he added.

Flexibility and human override must also be part of inventory and network optimization — another lesson the pandemic clearly showed. Given that black swan events keep happening, like the early 2021 Texas ice storms, and the Suez Canal blockage, automating everything without human oversight can leave companies in a lurch.

"Five years from now, you're going to be an outlier if you don't have this technology implemented."

Chris Riemann

Managing director of supply chain and network operations at Deloitte

George Lawrie, vice president and principal analyst at Forrester, points to a European grocer who maintained at least 98% availability in almost all categories at the start of the pandemic, when just about everyone else ran out of staples like rice and powdered milk. It did so by changing parameters for safety stock "that made up the system so it would continue to re-order these things even if it didn't have the demand signal to do so," he said.

Clients he's spoken to about using this kind of technology have said, "we don't want to automate everything. We want our people to be smart."

Top tech investments for supply chain resilience

| Technology type | % of companies increasing or substantially increasing investment in the technology |

|---|---|

| Inventory & network optimization | 54% |

| Cloud computing & storage | 54% |

| Robotics & automation | 53% |

| Sensors & automatic identification | 52% |

Source: 2021 MHI Annual Industry Report

Lawrie also suspects that, as pay models change for supply chain professionals, anyone still on the sidelines will embrace inventory and network optimization.

"Lots of people in supply chain come from procurement backgrounds where bonuses are paid on securing the lowest unit cost on whatever they're procuring," he said. "We're beginning to see people being paid a little bit differently, and paid more on the overall impact of supply chain and that it can maintain service."

This story was first published in our weekly newsletter, Supply Chain Dive: Operations. Sign up here.