Dive Brief:

- As much as 25 to 50% of Yellow's freight could go to carriers outside the top 10 LTL providers, according to a Wednesday research note by Goldman Sachs.

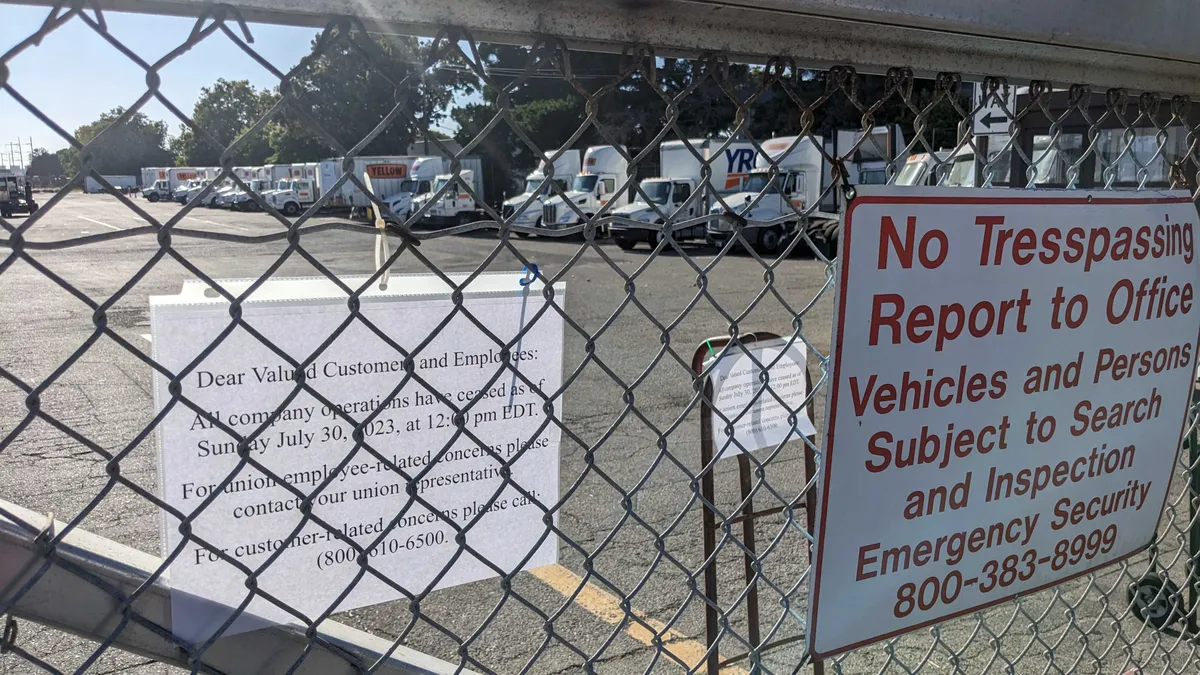

- Pivoting began early as shippers diverted freight, and large carriers weren't the only benefactors. Days before Yellow filed for bankruptcy Aug. 6, DAT Chief of Analytics Ken Adamo told Transport Dive smaller regionals were slammed with activity.

- LTLs are taking on different levels of freight, and a surge in shipments with providers such as Saia might not necessarily involve new business. LTL veteran Scooter Sayers, who runs the consulting firm Sayers Logistics, said he thinks their growth is coming from customers that Saia shared with Yellow.

Dive Insight:

Major LTL providers reported boosts in volume as Yellow exited the market, but they’re taking on loads differently.

Shippers may want to stick with a unionized carrier, helping to explain volume boosts with ABF Freight and TForce Freight, Sayers said.

Meanwhile, multiple carriers reported how they wanted to make sure their existing customers would still get the level of service they’ve been receiving. Old Dominion Freight Line President and CEO Kevin “Marty” Freeman told investors July 26 that the carrier would maintain its service capabilities with existing customers.

“We're not going to do anything to trash our service by taking on too much freight,” Freeman said on an earnings call.

Interim Q3 reports will provide a further sense of which players might be taking on more freight than others, Goldman Sachs analysts wrote.

For shippers looking to lessen price increases given the LTL disruption, analysts suggested that consolidations are undergoing changes in the market.

“I think you're going to see more of that truckload activity, particularly coming from the Midwest going out to the West, going to California for example,” United Shippers Alliance Executive Director Gene Graves said.

At the same time, Yellow subsidiaries New Penn and Reddaway played a key role in servicing consolidated freight for shippers. Their shuttering is further impacting shippers' ability to consolidate, Sayers said, whether that's on their own or through consolidators.

"Two of the carriers that played a big role in making this happen are no longer around," Sayers said. "Yellow’s closing has been disruptive because it shut down some of the capacity for consolidations that was there.”