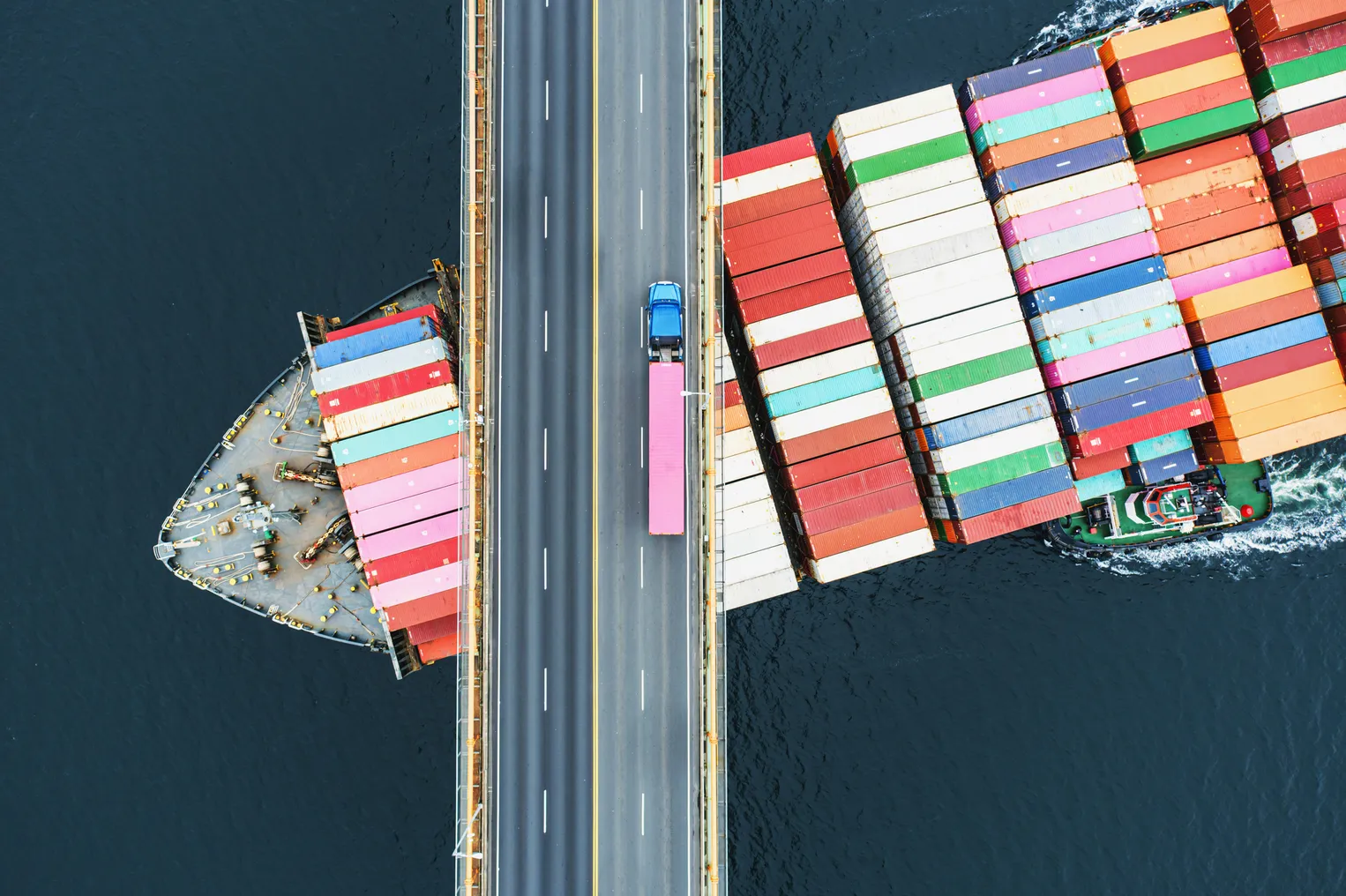

Shortages 2024: What supplies are still at risk after years of disruption?

While firms today might be more worried about the possibility of inventory pile-ups than product scarcity, the age of port congestion, empty shelves and toilet paper shortages is not far behind us.

Risks beyond the pandemic abound — political, economic, environmental, financial and more.

“If 2023 was the year of ‘what’ in terms of what the problem is or what the challenge is, in 2024 we’re going to start getting into the how’s and then actually doing it,” said Simon Geale, executive vice president at procurement services firm Proxima. “I think we’re going to see quite a lot of progress on localization, reshoring and resilience in the early part of 2024.”

Despite the scars of the pandemic, the sharp swing from high demand and product scarcity to overabundance of inventory and weak spending have renewed longstanding priorities around cost and profit margins.

“Currently, there is a strong focus on cost management and cost insulation to protect profitability. Most companies try to avoid a holistic transformation of their supply chains,” said Philipp Oemler, a managing director with FTI Consulting.

At the same time, Oemler thinks attitudes have changed in organizations since the pandemic brought widespread disruptions to supply chains.

“From my point of view, there is a mind shift,” Oemler said, noting that since the pandemic “people came to the conclusion that the supply chain is one of their strategic forces and that they need to secure it. The pendulum is going more to the direction of cost, but still there is still a mindset of resilience.”

And there is cause for a resilience-mentality. Circumstances and systemic challenges continued to put pressure on supplies of some key commodities, while other hard-to-predict risks could create shortages no one can foresee with perfect accuracy today.

Here is a look at where shortages might strike in 2024:

Pharmaceuticals and medical supplies

Shortages of certain medicines continued to plague hospitals and providers through 2023, and many of the underlying dynamics have not been resolved.

The Food & Drug administration still lists shortages for some cancer treatments such as carboplatin and cisplatin — which have caused astronomical price spikes. Those are in addition to dozens of other medicines in short supply.

Stocks of some medical machinery have also been under strain. Supply disruptions for both devices and treatments have caused surgical cases to be rescheduled, postponed or canceled, according to a 2023 survey by the patient safety nonprofit ECRI and the Institute for Safe Medication Practices.

In the medical device space, many of the supply chain issues are upstream from manufacturers.

“When I’m working with medical device companies — with nine out of 10 — the question is: ‘How do I increase the stability of supply for my suppliers,’” said Rick van der Vegte, a senior managing director in FTI’s life science practice. “You cannot switch suppliers that easily and quickly in the medical device space.”

Supply disruptions can be exacerbated by the long lead times in manufacturing supply chains for both medicines and devices, van der Vegte noted. Mitigating those risks also takes time. Finding and onboarding another qualified supplier can take at least a year, he added.

Given the time it takes to bring in new suppliers, assessing and addressing risk early can potentially head off disruptions. Van der Vegte pointed to a European medical device company he worked with to conduct a full risk assessment on its supply.

“We found out that most of these risks could be eliminated by either changing contracts or by identifying alternative suppliers,” he said.

Food

War and weather have put the broader food system on alert, where it may remain for the foreseeable future.

“I don’t think it’s possible to go into any year at the moment without having food supply at the top of your risk register,” Geale said.

Analytics firm Everstream listed agricultural commodity shortages as one of its top supply chain risks in 2024, citing in part production halts in 2023 during a turbulent year for crops.

2023 has brought spiking cocoa and sugar prices, the latter of which spurred a federal government watchdog agency to push for policy changes. Heat and drought in Europe created shortages of olive oil that drove prices up globally.

Going into 2023, concerns swirled around potential shortages as war raged between two large grain-producing countries — Ukraine and Russia. Ukraine’s exports fell in 2023, and farmers in the country have abandoned millions of acres of land. So far, though, the worst has not come to pass.

“While lower exports of agricultural commodities from Ukraine continue to contribute to tighter and more volatile global markets, trends in Ukrainian exports are becoming less and less important to overall expectations for global commodity markets, as supply chains and the global market have largely adapted,” the Famine Early Warning Systems Network said in an October analysis.

“Rather, greater concern exists for the impacts of future potential shocks,” the organization added, pointing to the potential of war in the Middle East.

Battery minerals

As countries and businesses scramble to revamp their energy use, companies are competing for key materials used to make batteries for electric vehicles and other green technologies.

Between 2017 and 2022, global demand for lithium tripled, while demand for cobalt jumped 70% and nickel demand climbed by 40%, according to a market review from the International Energy Agency. Prices, meanwhile, continue to “remain well above historical averages.”

Concerns continue around whether the supply of those and other minerals will be able to keep up with increasing demand. Geographical concentration of mining and refining adds to the tension over battery materials. In response, the Biden administration has put money and energy behind developing a domestic supply chain for minerals such as lithium.

Major private sector players have also invested in mining and refining. In 2023, the fossil fuel giant Exxon Mobil said it was looking to break into the EV battery lithium supply market, starting with a drilling site and processing plant in southwest Arkansas.

Manufacturers, meanwhile, are racing to secure their own supply. Ford has signed multiple long-term lithium contracts. Fellow automaker GM has invested in a lithium producer and plans to invest another $650 million with a Canada-based lithium mining specialist to develop a Nevada lithium mine. The list goes on, and for other minerals as well.

Climate-driven shortages

The climate is changing, with extreme weather events happening with greater frequency and ferocity. That will only worsen with time, especially if humanity fails to speedily reduce carbon emissions. And impacts on supply chains will increase as well.

Any extreme weather event can slow or even halt the production or transport of supplies. Last summer, for example, a tornado damaged a Pfizer pharmaceutical plant in North Carolina, leading to a temporary closure. The closure sparked concerns about supply shortages. Months passed before the factory could return to full-capacity.

Elsewhere in the world, protracted droughts slowed major shipping channels, including the Panama Canal and Mississippi River. Droughts and heat waves also hit olive oil production in Spain and cocoa harvests. Extreme weather in India caused shortages and massive price spikes of tomatoes, a dietary staple in the country.

Everstream, which listed extreme weather disruptions as its top supply chain risk for 2023, pointed to shipping delays caused by wildfires in Canada in 2023 as well as heavy rains and flooding in the Southwest.

“As we saw last year, particularly in India, a bad harvest, or climate disruption, and a significant proportion of the world’s [food] supply gets out of kilter,” Geale said.

These are just previews of challenges to come. At a Senate hearing in October, experts pointed to the effects climate disruption could have on ports and commodity supplies such those for semiconductors, many of which are produced in Taiwan — where typhoons could have an increasing impact on manufacturing.

Geopolitical-driven shortages

Procurement and supply chain teams are also watching political developments as they make plans for 2024 and beyond.

Since the China tariffs first instituted by the Trump administration, imports from the country have decreased significantly and firms have looked to diversify their sourcing. Republican candidates have voiced support for the idea of ending China’s permanent normal trade relations status, which would give rise to yet heftier tariff rates on imports. The National Retail Federation took the proposals seriously enough to commission a study on the potential impact, which found such a policy move would lead to $31 billion in added costs for consumers.

Recent wars have also given rise to concerns about shortages, with increases in fuel costs and grain prices following Russia’s invasion of Ukraine, and war in the Middle East slowing ocean transport and creating jitters over fertilizer supplies.

Oemler also noted the possibility of conflict around Taiwan — another major supply chain risk looming over this year highlighted by Everstream — as potentially having a major impact on global trade and production. Firms are already thinking about the potential for conflict as they make sourcing decisions.

“They’re investing more in diversification of their supplier base and also on long-term agreements,” he said.